Trade tensions between the US and China are heating up again, and this time, the fallout could be deeper, faster, and harder to predict. What started years ago as a targeted tariff dispute has evolved into a wider power struggle shaping global commerce.

The impact is already visible. In the first four months of 2025, US exports to China dropped by 12%, while imports fell by 7%, narrowing the trade deficit from $95 billion to $88 billion year-over-year. These shifts signal not just temporary friction but deeper realignments in cross-border trade, especially as the US will launch a tariff war in June.

Each new round of negotiations now carries serious implications. Tariffs, retaliations, and shifting regulations are disrupting sourcing strategies, pricing models, and buyer behavior across industries.

This article breaks down the history of the conflict, recent developments in tariff talks, sector-level disruptions, and what these changes mean for exporters navigating this uncertain landscape.

Key Takeaways

- Tariffs between the US and China surged in 2025, hitting up to 145%, disrupting trade flows and opening doors for Indian exporters.

- Electronics, agriculture, and intermediate goods faced the hardest hits, creating urgent sourcing gaps that India can fill.

- Talks between both countries resumed, but unresolved issues like IP and tech transfers keep trade conditions unstable.

- Non-tariff barriers such as export controls on chips and software are shifting global supply chains faster than tariffs.

- Indian exporters must track tariff changes live, avoid China-origin tags, and use platforms that support real-time logistics control.

How the US-China Trade War Started?

To understand where we’re headed, you need to grasp how this economic conflict began and why it escalated so rapidly.

The 2018 Escalation Timeline

The current trade conflict started in 2018 when the Trump administration imposed the first wave of tariffs on Chinese imports. What began as targeted measures on steel (HS Code: 7218) and aluminum quickly expanded into a full-scale trade war.

The US government cited three primary concerns that drove its actions:

- Intellectual property theft – Estimated cumulative losses of $600 billion.

- Forced technology transfers – Requirements for US companies operating in China.

- Massive trade deficit – Reaching $419 billion by 2018, the largest bilateral imbalance in history.

Key Tariff Rounds That Shaped Today’s Situation

The escalation followed a predictable pattern. Each round of US tariffs prompted immediate Chinese retaliation, creating a spiral that ultimately affected over $500 billion in bilateral trade.

Here’s how the major rounds unfolded:

- Round 1 – $34 billion in Chinese goods hit with 25% tariffs.

- Round 2 – China retaliated against US agricultural products, targeting soybeans and pork.

- Round 3 – Tariffs expanded to consumer electronics and intermediate goods.

- Round 4 – Both countries reached tariff rates as high as 25% on many categories.

This escalating pattern created the foundation for today’s ongoing negotiations and continues to influence your export opportunities.

Tariff Escalations and Sectoral Damage

The impact of these tariff wars was not felt equally across all industries. Some sectors faced devastating disruptions while others found unexpected opportunities.

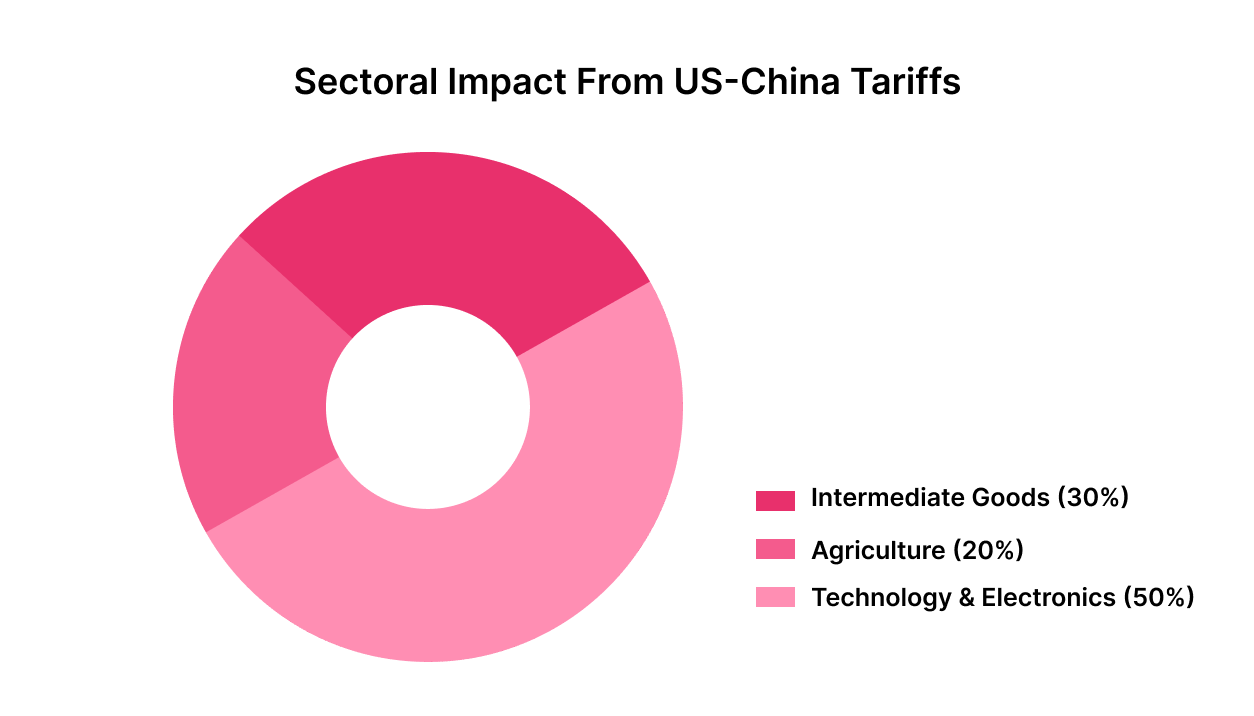

Technology and Electronics Bore the Brunt

The technology sector suffered the most severe impact from these trade measures. Semiconductors, smartphones, and computer components faced some of the highest tariff rates, fundamentally changing how these industries operate.

Chinese tech giants found themselves cut off from US suppliers overnight. Meanwhile, American companies struggled with component costs that jumped by 25% or more. This forced manufacturers to completely reassess production strategies they’d developed over decades.

For Indian exporters, this disruption opened immediate opportunities in electronics assembly and component manufacturing.

Agricultural Retaliation Hit American Farmers Hard

China’s response targeted American agriculture with surgical precision. China imposed a 15% tariff on chicken, wheat, corn, and cotton, and a 10% tariff on sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products.

American farmers, particularly soybean producers, watched their largest export market disappear almost overnight. This created immediate pressure on US policymakers and highlighted how interconnected global food systems had become.

Intermediate Goods Caused the Most Long-Term Damage

The most damaging aspect involved tariffs on intermediate goods – components that cross borders multiple times during manufacturing. These measures disrupted supply chains that had evolved over decades.

Companies faced impossible choices:

- Absorb higher costs and squeeze profit margins.

- Find new suppliers in different countries.

- Relocate the entire production facility.

- Passing costs to consumers risks losing market share.

This disruption continues to create opportunities for Indian exporters looking to step into these gaps. They can use Intoglo to move full-container shipments, compare port tariffs in real time, and ensure compliance with every new US trade shift.

Ready to shift your supply chain around rising US tariffs?

Contact Intoglo today!What Changed in 2025?

As we move deeper into 2025, the trade war landscape has evolved significantly, bringing both new challenges and fresh opportunities for your export business.

Recent Tariff Developments You Need to Know

The year 2025 brought a dramatic escalation with the US imposing 145% tariffs on Chinese goods, prompting China to retaliate with 125%duties. However, recent developments suggest both sides recognize the need for de-escalation.

In a surprise breakthrough, the United States and China agreed to drastically roll back tariffs on each other’s goods for an initial 90-day period. This temporary agreement has buoyed global markets and created planning opportunities for exporters.

Political Dynamics Driving Policy Changes

The current administration faces multiple pressures that directly affect your export planning. Manufacturers push for protection, while retailers demand lower tariffs to ease inflation.

Taiwan tensions have added another complex layer. Trade negotiations now occur against a backdrop of strategic competition that extends far beyond commercial interests.

Economic Goals and Election Cycle Impact

Political calendars significantly influence trade policy timing. You’ll notice that major trade announcements often coincide with domestic political needs, creating uncertainty for businesses trying to plan long-term strategies.

This political reality means you need flexible export strategies that can adapt quickly to policy changes.

Unsure how changing US trade policy will affect your next shipment?

Talk to Intoglo’s team for expert guidance.Is the Trade War Talk Still Progressing?

Understanding the actual progress in negotiations helps you make better decisions about market timing and investment priorities.

Recent Negotiation Rounds Show Promise

Recent talks indicate that both sides remain engaged in serious discussions. These negotiations represent the most substantive engagement between the two countries in months.

The talks focus on several areas that directly affect your export opportunities:

- Agricultural purchase agreements.

- Technology transfer requirements.

- Tariff reduction timelines.

- Intellectual property protection measures.

What Has Been Agreed

In 2025, the US and China reached a temporary tariff truce that eased some of the highest duties imposed earlier this year. The agreement focuses on rolling back extreme tariffs, improving trade facilitation, and securing China’s commitment to resume critical exports like rare earth minerals.

Unlike the 2020 Phase One deal, the current negotiations do not include formal purchase targets for US goods, reflecting lessons learned from previous enforcement challenges. While this marks a positive step toward de-escalation, the situation remains fluid, and ongoing talks will determine the longer-term trade relationship.

Sticking Points That Remain Unresolved

Several critical issues continue to complicate negotiations and create ongoing uncertainty for your export planning:

- Intellectual Property Protection – The US demands structural changes to Chinese law, while China insists on maintaining sovereignty over its legal system.

- Technology Transfer Requirements – US companies want guarantees against forced technology sharing, while Chinese officials view these demands as attempts to limit technological advancement.

- Enforcement Mechanisms – Both sides struggle to create binding agreements that can survive political changes and economic pressures.

These unresolved issues mean you should prepare for continued volatility in trade policies.

Also Read: US-China Trade War: A Guide to Understanding Tariff Impacts

Non-Tariff Tensions: Export Controls and Tech Sanctions

Beyond traditional tariffs, a complex web of non-tariff measures creates both risks and opportunities for your export business.

Semiconductor Restrictions Reshape Global Supply Chains

The US has implemented sophisticated export controls targeting China’s semiconductor industry. These measures restrict access to advanced chips, manufacturing equipment, and design software in ways that affect global commerce.

The restrictions impact not just Chinese companies but entire supply chains. Many multinational corporations find themselves choosing between US export compliance and Chinese market access.

AI and Software Access Controls

Artificial intelligence has become a particular focus of these restrictions. The US limits Chinese access to advanced AI chips and cloud computing services, arguing these technologies have military applications.

Software restrictions prove equally disruptive. Major US software companies have been forced to limit or halt services to Chinese customers in specific sectors, creating gaps you might fill.

Global Supply Chain Impact on Your Business

These non-tariff measures often have a greater long-term impact than traditional tariffs. They force fundamental restructuring of supply chains and research partnerships that took decades to build.

For your export business, these restrictions create specific opportunities:

- New business in sectors previously dominated by Chinese suppliers.

- Partnerships with companies seeking Chinese alternatives.

- Access to customers, avoiding Chinese supply chains.

However, exporters must ensure compliance with US export control requirements to avoid legal complications.

Want to stay compliant while exporting to the US under tighter regulations?

Get instant quotes!How Domestic Pressures in the US and China Are Rewriting Trade Rules?

The trade war’s domestic impact in both countries creates ripple effects that directly influence your export opportunities.

Manufacturing Reshoring Efforts Create New Dynamics

Both countries have launched major initiatives to reduce supply chain dependence. The US introduced significant subsidies for domestic semiconductor manufacturing, while China accelerated technology independence programs.

These efforts show mixed results. Some manufacturing has returned to the US, but much has simply shifted to other countries rather than coming home entirely. This shift creates opportunities for Indian manufacturers.

Inflation and Consumer Impact Drive Policy Changes

American consumers bear much of the tariff cost through higher prices. Studies show that tariffs function essentially as taxes on imports, with costs typically passed to end users.

The inflationary impact has become a significant political issue, forcing policymakers to balance protectionist goals against consumer price pressures. This creates openings for competitively priced Indian exports.

Policy Fatigue Creates Opportunities

Recent polling suggests growing public concern about the economic costs of trade tensions. Both countries show signs of domestic pressure to find compromises that reduce economic disruption.

Business communities in both countries increasingly advocate for predictable trade rules rather than ongoing uncertainty, even if those rules are less favorable than previous arrangements.

This policy fatigue works in your favor, as both governments seek solutions that reduce economic disruption while maintaining political credibility.

But the impact of these domestic pressures doesn’t stop at the US or Chinese borders. As both countries adjust their trade policies, the effects are felt across global supply chains, reconfiguring sourcing decisions, shifting buyer preferences, and opening doors for alternative partners. This is where India enters the picture with new strategic relevance.

Global Ripple Effects and the Role of India

The US-China trade war has created a fundamental shift in global trade patterns that positions India for unprecedented growth opportunities.

Supply Chain Diversification Accelerates

Companies that previously relied heavily on Chinese suppliers now actively seek alternatives. This diversification trend accelerated significantly under the Biden administration and continues under current policies.

You’re perfectly positioned to benefit from this shift. Companies require reliable suppliers capable of meeting quality standards, scaling requirements, and delivering within timelines that Chinese suppliers previously handled.

Friend-Shoring Creates Strategic Advantages

The concept of friend-shoring – moving supply chains to politically aligned countries – has gained significant traction among US companies: India’s democratic government and strategic partnership with the US position Indian exporters to benefit from this trend.

Recent data shows exports to the US have increased significantly, with India’s exports increasing by 22.18%. This demonstrates the concrete benefits of friend-shoring policies.

Exporters looking to make the most of these friend-shoring shifts can consider using Intoglo, which works directly with shipping lines, has no intermediaries, and supports D2C brands and Amazon FBA shipments into the US.

PLI Scheme Impact Amplifies Opportunities

India’s Production Linked Incentive schemes have gained additional relevance in this context. These programs offer financial incentives for manufacturing in sectors where companies are reducing their dependence on China.

Key sectors benefiting from PLI schemes include:

- Electronics and semiconductors

- Automotive components

- Pharmaceuticals and chemicals

- Textiles and garments

- Food processing.

The timing of these schemes coincides perfectly with global supply chain restructuring, potentially accelerating your integration into new trade networks.

Avoiding China-Origin Tags Becomes Critical

Many US importers now actively seek products without Chinese components to avoid tariff complications. This creates specific opportunities for you if you can provide fully integrated alternatives.

However, this requires careful supply chain management. You must ensure that your products don’t inadvertently include Chinese components that could trigger US tariffs on your customers.

Also Read: US-China Trade War Escalation with New Tariffs

What Indian Exporters Should Watch, Plan, and Do Next?

Success in this evolving trade environment requires specific strategies and tools that help you stay ahead of rapid changes.

Monitoring Tariff Announcements in Real-Time

Trade policies change rapidly, making real-time monitoring essential for your export planning. Recent announcements suggest tariffs on China will go into effect as soon as next week, although analysts believe this may be a negotiating tactic.

You need systems that provide immediate updates on tariff changes, preferably with sector-specific analysis of how changes affect your particular products.

Hedging Risk Strategies That Work

Smart exporters develop multiple strategies to manage trade war risks. This approach protects your business from sudden policy changes while positioning you to capitalize on new opportunities.

Diversification Strategies

- Multiple customer bases across different markets.

- Flexible supply chains that can shift quickly.

- Relationships with freight forwarders who understand complex regulations.

Financial Protection

- Currency hedging to manage rupee-dollar volatility.

- Credit insurance for international shipments.

- Flexible payment terms that account for trade uncertainties.

Port Cost Visibility Becomes Critical

US port costs have become increasingly volatile due to trade tensions and supply chain disruptions. Having real-time visibility into port charges, storage fees, and processing times can significantly impact your bottom line.

Extended free days at US ports, such as 10-day extensions that some freight forwarders offer, help you avoid unexpected demurrage charges during uncertain times.

Platform Solutions for Real-Time Updates

Modern freight forwarding platforms now offer sophisticated tracking and alert systems that help you stay ahead of trade developments. These systems integrate tariff monitoring, shipment tracking, and cost analysis in a single dashboard.

The best platforms also provide predictive analytics that help you anticipate potential disruptions before they affect your shipments. This capability becomes invaluable during periods of rapid policy change.

Conclusion

The US-China trade war has reshaped global trade flows, but for Indian exporters, it’s also opened new lanes of opportunity. With rising tariffs, changing sourcing patterns, and demand realignment, agility and control have become the edge. Exporters who move quickly and stay informed can turn trade disruptions into strategic wins.

Intoglo helps you stay ahead with:

- FCL Shipping: Reliable full-container load shipments from India to the US, with instant rate quotes and real-time tracking.

- Door-to-Door Logistics: End-to-end freight movement, from your warehouse in India to the buyer’s doorstep in the US.

- Amazon FBA Warehouses: Implementing on-ground storage facilities near major ports and Amazon FBA warehouses fulfillment centers can help reduce last-mile costs and lead times.

- FBA Shipments: Smooth freight and compliance support for sellers shipping to Amazon’s US warehouses, including labeling and palletization.

- HS Code Scanner: Ensure the correct classification of goods to avoid penalties and benefit from applicable duty exemptions.

- Customs Clearance & Compliance: Streamlined clearance processes with country-specific documentation, filing, and regulatory support built in.

Global trade has shifted. Intoglo gives Indian exporters the tools to adapt, respond faster, and deliver with certainty, no matter what the following policy change brings.

Are you ready to ship to the US with clarity and control? Contact us today.

FAQ’s

1. Did Trump reduce tariffs on China?

No, Trump maintained or raised tariffs during his term to pressure China on trade practices. His administration introduced multiple rounds of duties targeting industrial and consumer goods, reinforcing his broader strategy of economic confrontation with China.

2. What is the tariff rate from China to the US?

In 2025, tariff rates on Chinese goods vary by category, with some exceeding 100%. Rates are highest on electronics, semiconductors, and key industrial components. Importers should check the specific HS code to determine the exact duty rate applied.

3. Do I have to pay customs for a package from China in 2025?

Yes, most shipments from China to the US incur customs duties. Thresholds for duty-free entry remain low, and additional fees may apply depending on product type, declared value, and any relevant trade restrictions in place.

4. How to avoid tariffs from China?

To avoid tariffs, importers often shift sourcing to alternative countries, restructure supply chains, or ensure final products exclude China-origin components. Some also use tariff engineering or leverage trade agreements with lower-duty partners outside China’s trade jurisdiction.

5. Who has the power to impose tariffs?

In the US, the President holds the authority to impose tariffs under various trade laws. Agencies like USTR and the Department of Commerce execute decisions, often after investigations into unfair trade practices, national security concerns, or economic harm.

Leave a comment