If you’re exporting across the US–Canada border, the last few months may have thrown your operations into chaos. It started when the US raised tariffs on Canadian steel and aluminum, first 25%, then a sharp jump to 50% on aluminum alone. That move disrupted billions in trade and sent a clear signal: economic pressure is back on the table.

Canada wasted no time. In March 2025, it introduced retaliatory tariffs covering CA$29.8 billion worth of US goods. The list hit essential sectors like vehicles, food products, and industrial machinery, forcing exporters to recalculate pricing, sourcing, and timelines almost overnight.

This shift affects manufacturers, logistics teams, and trade professionals who are trying to maintain their competitive edge. Border friction is tightening, compliance costs are climbing, and buyers on both sides are starting to feel the strain.

This blog breaks down what triggered the latest U.S. tariff on Canada moves, which sectors are most vulnerable, and what steps you should be taking now to stay ahead.

Key Takeaways

- The U.S. raised tariffs on Canadian steel and aluminum, triggering a swift retaliatory response from Canada.

- Canada imposed targeted tariffs worth nearly $30 billion, aimed at U.S. sectors like agriculture, vehicles, and consumer goods.

- These actions disrupted supply chains, increased costs, and forced exporters on both sides to reassess pricing and sourcing.

- Indian exporters now face new opportunities as U.S. buyers seek alternative suppliers amid trade volatility.

- Flexible routing, accurate HS code classification, and real-time tariff tools are now essential to stay competitive.

What Triggered the New U.S. Tariffs on Canada?

The United States imposed its new tariffs on Canada based on three core justifications that immediately disrupted cross-border trade.

The first was national security. The Trump administration claimed that relying on Canadian steel and aluminum posed risks to U.S. defense production. Invoking national security exemptions allowed the U.S. to bypass standard trade rules, even against a close NATO partner.

The second was border control. Trump directly tied tariffs to immigration and drug enforcement, stating they would remain until the flow of fentanyl and illegal migrants stopped. This turned trade policy into a tool for non-economic objectives, using economic pressure to demand cooperation on U.S. border priorities.

The third was domestic industry support. U.S. steel and aluminum producers had pushed for years to curb foreign competition. These tariffs gave them short-term relief from imports, while passing higher costs onto manufacturers who depend on those inputs.

The timeline made the escalation clear. In November 2024, the U.S. announced threats against all Canadian and Mexican products. By March 2025, tariffs targeted metals. In June, aluminum duties doubled, and new tariffs hit vehicles and energy imports. Each round narrowed exemptions and increased pressure on Canada.

Why Did Canada Retaliate? Understanding the US Tariff Escalation

Canada hit back because it viewed the U.S. tariffs as unjustified, damaging, and a clear breach of trade commitments. The government saw no option but to respond, both to protect its economy and to push back against what it considered a misuse of trade policy.

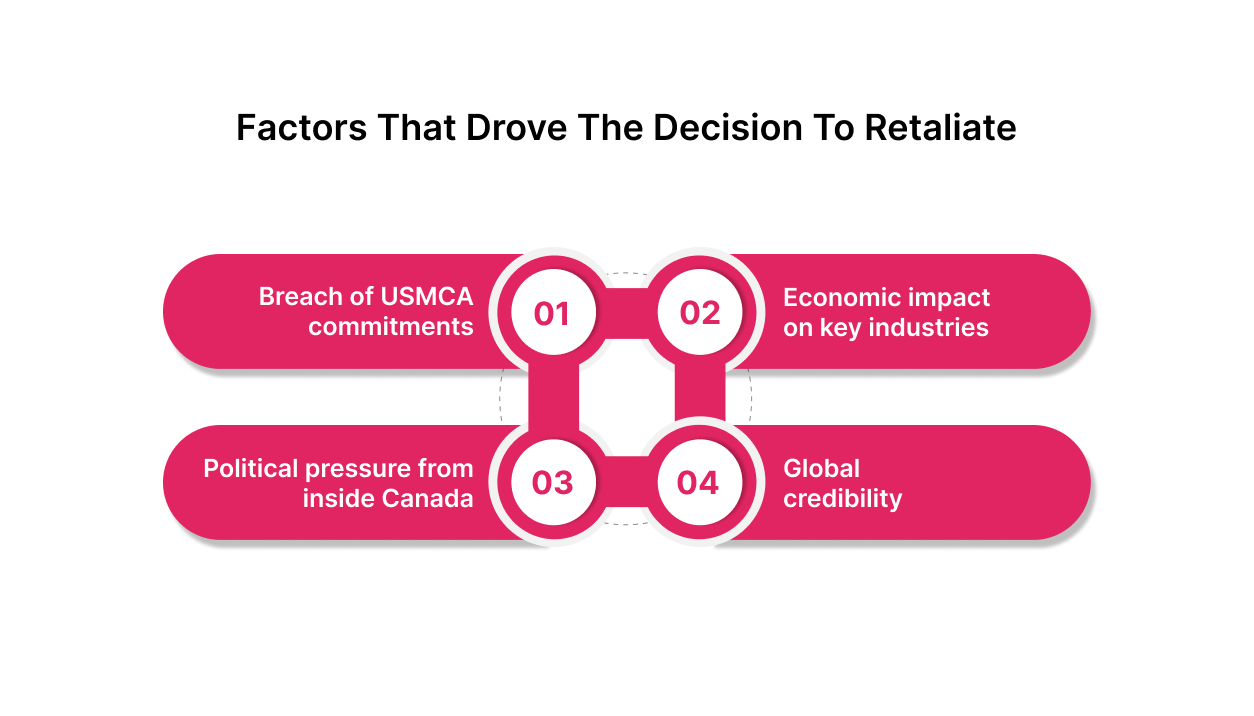

Below are several overlapping factors that drove the decision to retaliate:

1. Breach of USMCA commitments

The tariffs directly contradicted the USMCA deal, which both sides had only recently renegotiated. Canadian officials pointed out that these actions broke the terms of the agreement Trump himself had signed, and they immediately explored legal retaliation through the agreement’s dispute channels.

2. Economic impact on key industries

In 2024, bilateral trade in steel and aluminum alone reached $14 billion, with $11 billion of that coming from aluminum exports. These sectors are central to industrial regions like Ontario and Quebec. Letting the tariffs stand would have meant permanent damage to major industries.

3. Political pressure from inside Canada

International trade plays a vital role in Canada’s economy, accounting for roughly two-thirds of the country’s GDP. Export activity alone is responsible for supporting nearly 4 million jobs nationwide. Labor unions, manufacturers, and provincial leaders pushed hard for a strong federal response. Ignoring that pressure was not an option.

4. Global credibility

Canada also had a broader message to send. Officials framed the retaliation as a defense of fair trade, warning that failing to respond could invite similar treatment from other partners. This was about protecting Canada’s position in the global system.

Now that you know why Canada couldn’t afford to stay quiet, it’s time to look at how it hit back. Up next, we will examine Canada’s retaliation strategy and how the response was designed to apply maximum pressure to the US.

How Canada Responded with Retaliatory Tariffs?

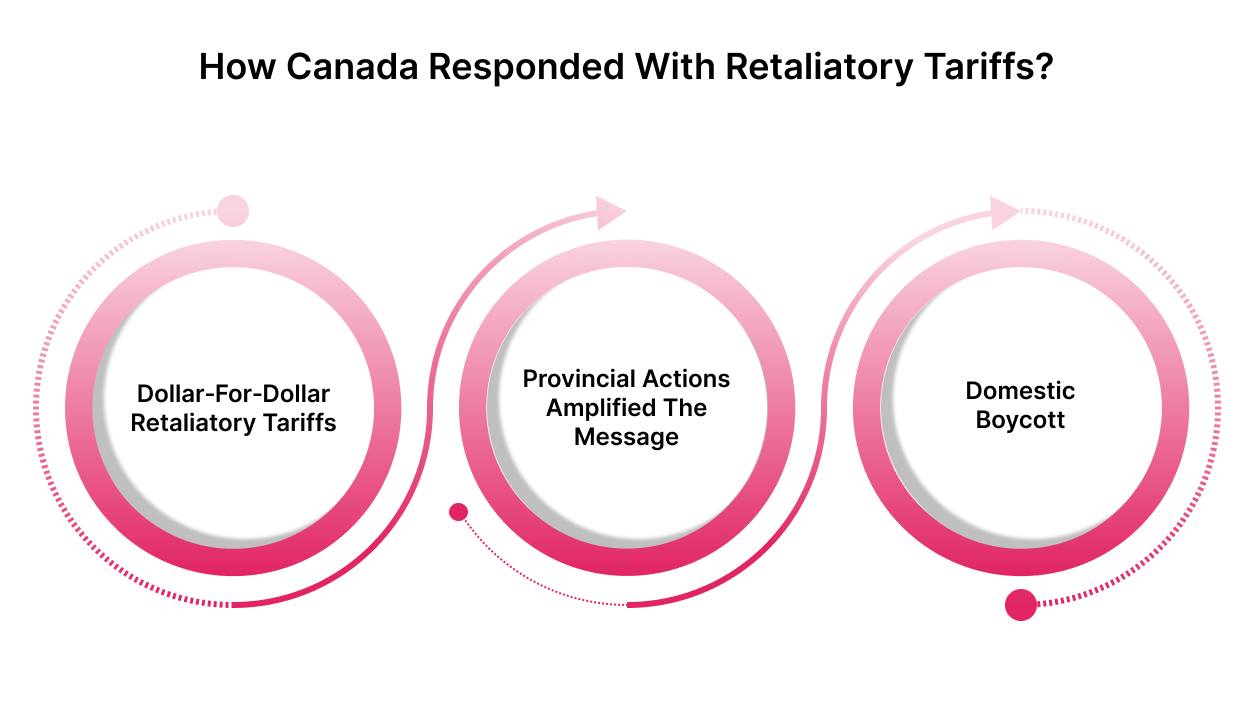

Canada responded quickly and precisely, targeting U.S. goods to drive political pressure while minimizing harm at home. Here’s how the strategy unfolded:

1. Dollar‑for‑dollar retaliatory tariffs

- Phase 1 (February 4, 2025): Imposed a 25% tariff on roughly C$30 billion of U.S. imports, covering items like orange juice, peanut butter, wine, appliances, clothing, cosmetics, paper goods, motorcycles, and beer.

- Phase 2: Rolled out another 25% tariff targeting steel (C$12.6 billion), aluminum (C$3 billion), and various other goods (C$14.2 billion), a total of C$29.8 billion more.

- Automobiles and parts: Applied tariffs on cars and auto parts based on CUSMA compliance, either on the non‑Canadian content or the full value for non‑compliant vehicles.

2. Provincial actions amplified the message

Several provinces took symbolic and practical steps to reinforce the federal response:

- Ontario pulled U.S. liquor from shelves and banned American alcohol.

- British Columbia, Alberta, Manitoba, Quebec, and others followed, banning liquor, reviewing or penalizing procurement contracts, and imposing tolls on U.S. vehicles in some cases.

3. A “Buy Canadian” sentiment took hold

Canadians were encouraged to favor domestic goods and services, aiming to amplify economic impact in the U.S. while maintaining national unity. A grassroots boycott of U.S. products and travel also took hold, reflecting widespread public engagement with the trade conflict.

While the measures were designed to pressure Washington, they didn’t come without cost. As tariffs escalated, Canada’s industries began to feel the strain, from rising input prices to disrupted supply chains. Now, let us see where the retaliation started, hitting back at home.

Economic Impact of Canadian Retaliation on Their Industries

Canada’s retaliation triggered economic strain across its industries, raising input costs, shrinking export margins, and unsettling long-standing supply chains.

In trying to match Washington’s tariffs, Canadian countermeasures hit close to home. Industries like automotive, food processing, and steel bore the brunt. Many of these sectors relied heavily on U.S. imports for raw materials or cross-border trade volumes to stay profitable.

To understand the depth of that disruption, here’s how specific Canadian industries were hit by their retaliatory tariffs, and what consequences followed across each sector.

- Automotive: U.S. tariffs had already disrupted the supply chain. Canada’s response added cost and sourcing pressure, especially for Ontario’s vehicle parts industry. Production setups became harder to maintain without adjustments.

- Steel and Aluminum: Tariffs on both sides raised input prices and reduced export flexibility. Many suppliers were forced to either absorb higher costs or find new buyers under tighter timelines.

- Food and Beverage: Canadian tariffs on items like ketchup and whisky impacted processors who relied on American ingredients. While some domestic brands gained a short-term pricing advantage, manufacturers had to adjust sourcing strategies quickly.

- Manufacturing & Export Hubs: The broader manufacturing sector dealt with fewer exemptions compared to the 2018 tariff cycle. Export-heavy regions, particularly in Ontario and Quebec, faced narrowing margins and shifting procurement patterns.

For Indian exporters watching this play out, it’s a chance to move in, but only if your operations are flexible.Intoglohelps you react faster with live HS code tools, direct shipping line access (no intermediaries), full freight visibility, and built-in support for Amazon FBA and D2C fulfilment. So that when trade shifts, you stay in control.

Also Read: US-China Trade War: A Guide to Understanding Tariff Impacts

What US Sectors Are Feeling the Pressure from Retaliation

Retaliatory tariffs exposed how vulnerable key U.S. sectors are to supply chain shifts, foreign market exits, and rising input costs. For many industries, the blowback hurt more than the original trade spat.

Sectors Hit Hard by Canada’s Retaliation

Here’s where the impact has been most visible across the U.S. economy:

- Agriculture exports lost critical ground. Canadian importers canceled U.S. orders overnight, especially in border states like Michigan and Wisconsin. Many buyers turned to South America and Europe instead, and those lost relationships may not come back.

- U.S. households faced higher gasoline prices. Tariffs on Canadian crude pushed pump prices, triggering backlash from voters already under economic strain.

- Manufacturers took a double hit. Steel and aluminum tariffs raised input costs. Retaliatory measures then shut U.S. firms out of key Canadian export markets. Downstream industries, from auto parts to appliances, absorbed the worst of both.

- Trade groups split and scrambled. Chambers of commerce, manufacturing coalitions, and farm lobbies launched rapid campaigns for relief. But support fractured: raw material producers backed tariffs, while downstream exporters and consumer industries demanded rollbacks.

- Swing-state pressure grew fast. The most visible fallout landed in politically sensitive regions. Auto parts in Ohio, dairy in Wisconsin, and soybean shipments from Minnesota all took hits. This concentrated the political cost of tariffs in battleground states, forcing some lawmakers to break with the administration’s trade stance.

This concentrated the political cost of tariffs in battleground states, forcing some lawmakers to break with the administration’s trade stance. But for exporters outside North America, especially in India, this volatility opens new ground. As U.S. buyers look beyond Canada for stable, cost-effective alternatives, Indian suppliers have a real shot at filling those gaps.

With the right shipping control, tariff visibility, and fast quoting tools, they can step in quickly, and Intoglo makes that possible. From instant freight quotes to direct shipping line access and full FBA fulfilment support, Intoglo helps you move without delay or friction.

Want to ship directly to US buyers without intermediaries?

Talk to Intoglo’s team!How Canada’s Retaliation Reshaped Global Trade Behavior?

Canada’s response to U.S. tariffs led to a significant shift in how countries approach trade conflicts. It influenced global strategies, redefined retaliation tactics, and altered how nations prepare for economic pressure.

Retaliation Became More Tactical and Immediate

Before this dispute, most governments relied on WTO proceedings, which were slow, procedural, and often delayed. Canada introduced a faster, more calculated approach that others began to adopt.

Key changes:

- Governments responded immediately rather than waiting years.

- Tariffs focused on politically sensitive goods, not broad categories.

- Smaller economies began acting in coordination.

- Retaliation became a geopolitical tool, not just an economic measure.

Governments Strengthened Trade Resilience

Canada’s approach highlighted the risk of being unprepared. Countries started taking preventive steps to reduce exposure and manage potential disruptions.

New strategies included:

- Diversifying suppliers across regions.

- Building reserves of essential imports.

- Using multiple shipping routes to reduce dependency.

- Establishing trade alliances to enable joint responses.

Precision Tariffs Replaced Broad-Based Duties

Canada demonstrated that narrow, well-targeted tariffs can apply more pressure than sweeping ones. The idea was to influence political outcomes without excessive economic cost.

Now widely seen in practice:

- The EU targeted U.S. bourbon exports linked to key political regions.

- Mexico applied tariffs to U.S. corn, affecting Midwestern farmers.

- Japan imposed duties on select high-value technology components.

The focus shifted from scale to strategy.

Trade Conflicts Expanded Beyond Bilateral Disputes

Canada coordinated its response across federal, provincial, and international levels, setting a model for wider alignment. Trade disputes now involve multiple players and fronts.

What changed:

- Countries synchronize retaliation timelines.

- Targets are divided to maximize coverage and avoid overlap.

- Coalitions provide smaller nations with more substantial leverage.

- Conflicts extend across sectors and regulatory institutions.

Supply Chains Became Less Predictable

Retaliation cycles introduced volatility across global logistics. Companies with no direct stake in the dispute still faced delays, cost spikes, and compliance challenges.

Operational impacts:

- Freight rates increased on diverted shipping lanes.

- Firms adjusted their inventory to hedge against uncertainty.

- High-risk corridors changed routing decisions.

- Insurance and credit terms tightened due to policy risks.

Mid-Sized Economies Increased Their Influence

Canada’s model challenged the assumption that only large economies can influence trade outcomes. It offered a structured approach that others began to follow.

Global implications:

- Large economies face more organized opposition.

- Smaller countries negotiate with clearer leverage.

- Threats now carry higher diplomatic and financial consequences.

- Rules-based trade frameworks gained renewed importance.

All these shifts in retaliation tactics, supply chain planning, and trade alliances have opened up new gaps in the North American market. As an exporter, consider the US–Canada tension as a signal to reassess your strategy.

Ready to reroute shipments disrupted by Canada’s tariff fight?

Get instant rate quotes with Intoglo!Also Read: Guide to Calculate Export Duty from India to the USA

Where Do You Stand as an Indian Exporter? New Openings Amid US–Canada Trade Disputes

The US–Canada tariff standoff is redrawing trade lanes and shaking up sourcing decisions across North America. If you’re exporting from India, this is your opportunity to step in, but only with the right data, flexible logistics, and clean compliance.

Build Routing Flexibility into Your Supply Chain

Trade routes can shift overnight when tariffs change. If you’re relying on a single lane or transit point, you are exposing your margins to unnecessary risk. Consider alternate paths through Mexico or direct US-bound routes that avoid congested or tariff-impacted ports.

With Intoglo, you get access to direct shipping line partnerships, no intermediaries, and no agents, which makes route planning faster and more transparent. This is especially useful when you are selling through Amazon FBA warehouses or running a D2C model.

Monitor Tariff Schedules and HS Codes in Real Time

Tariff changes during trade disputes do not come with warnings. A profitable shipment today can become loss-making tomorrow if the HS code is not exact. Minor misclassifications can lead to double-digit duty swings or even customs holds.

Look for tools that give you:

- Live HS code finder and scanner.

- Product-specific duty rate tracking.

- Real-time classification assistance.

You can use them before you ship, not after you get flagged at the port.

Target Supply Gaps Left by Tariff Disruption

As U.S. and Canadian exporters face higher costs, gaps are opening across product categories, especially in consumer goods, intermediate parts, and seasonal inventory. If your pricing and compliance are aligned, you can step in while others pull back.

Intoglo’s USA Export Navigator helps you spot where these gaps exist. You can check which products are facing duty hikes, which states are underserved, and where Indian exports already meet regulatory thresholds.

Timing your entry here is necessary.

Strengthen Compliance Before It Slows You Down

Trade wars bring stricter inspections, tighter documentation checks, and more delays. Customs clearance gets slower for those who are not prepared, and costly for those who get it wrong.

With Intoglo, you get:

- Clean, validated shipping docs.

- HS code accuracy support.

- A carbon emissions calculator if you want to align with green standards for U.S. buyers.

Eager to fill the gaps in US-Canada trade with flexible export routes?

Reach out to our experts now!Conclusion

Tariff volatility is now a permanent factor in global trade. The Canada–US dispute highlights how quickly policy shifts can disrupt established supply routes and trade relationships. For Indian exporters, staying prepared means building the ability to respond without delay.

Even a minor change in duty structure can alter landed costs, shift buyer behavior, and impact your position in the market. This environment demands updated tariff intelligence, precise product classification, and flexible logistics that adjust as conditions change.

Intoglo supports Indian exporters with:

- Live HS code lookup, scanner, and US-specific tariff data.

- Instant freight quotes and real-time port cost visibility.

- Direct operations with major shipping lines with zero intermediaries.

- Door-to-door ocean FCL shipping.

- Amazon FBA delivery and D2C fulfilment support.

- Customs clearance assistance with expert classification help.

- Transloading, palletization, and inland trucking services are available across India and the US.

- 3PL warehousing in over 50 U.S. locations.

- Carbon emissions calculator and USA Export Navigator.

You get compliance guidance, faster decision-making, and full control over your logistics from origin to delivery.

Talk to our team today for tailored support on your India-to-USA shipments.

FAQ’s

1. How are the U.S. tariffs going to impact Canada?

The tariffs increase input costs for Canadian manufacturers and complicate trade planning. Industries dependent on cross-border supply chains must adjust operations, while businesses face delays, tighter margins, and shifting supplier relationships that weaken predictability across multiple sectors.

2. Does Canada have retaliatory tariffs?

Yes, Canada imposes retaliatory tariffs targeting selected U.S. goods. These measures aim to apply political and economic pressure while defending domestic producers. The strategy selectively impacts key American exports, allowing Canada to balance retaliation with controlled domestic disruption.

3. Who pays the U.S. tariffs on Canada?

U.S. importers pay the tariffs when bringing Canadian goods across the border. These businesses often pass higher costs to American buyers through price increases, affecting manufacturers, retailers, and consumers depending on the goods involved in the import transaction.

4. Did Canada reduce retaliatory tariffs on U.S. goods to almost zero with exemptions?

Canada issued targeted exemptions for some U.S. products but did not reduce overall retaliatory pressure to near zero. Adjustments serve economic needs and supply stability, but the broader tariff framework remains active and strategically focused on leverage.

5. How is Canada responding to steel tariffs?

Canada supports its steel sector through financial programs, advocacy in trade forums, and closer alignment with alternative markets. The response blends economic relief with long-term positioning, ensuring domestic producers remain competitive despite shifts in U.S. trade policy.

Leave a comment