The impact of the Trump Taiwan tariff emerged as one of the most significant side effects of the US-China trade war. Although Taiwan was not the direct target, the ripple effects were immediate. With $111 billion in goods exported to the US annually, 23% of Taiwan’s total exports, the island’s trade position was highly exposed.

Instead of absorbing the fallout, Taiwan acted quickly. It launched diplomatic outreach, restructured key supply chains, and opened new export markets. The result? By 2024, Taiwan’s exports to the US increased 32.5% year-on-year, driven by gains in electronics, machinery, and traditional manufacturing.

This blog examines how Taiwan responded to the Trump-era tariffs with speed and strategy. From government policy shifts to industry-level changes, it offers a practical playbook for exporters navigating tariff shocks and global trade disruptions.

Key Takeaways

- Taiwan turned Trump-era tariffs into growth by diversifying markets, reducing its reliance on China, and expanding U.S. production.

- Direct talks with Washington, strong political messaging, and corporate alliances helped secure tariff relief.

- Electronics drove advanced R&D, U.S. plants shifted to higher-value products, machinery transitioned to petrochemicals targeting ASEAN, and textiles transitioned into specialty goods.

- Government aid for SMEs included low-interest loans, market grants, tech upgrades, and trade intelligence support.

- Indian exporters can apply similar tactics by diversifying markets, building policy influence, investing in technology, and strengthening supply chains.

How Trump’s Tariff Policies Affected Taiwan’s Trade Flow?

Taiwan felt Trump’s tariff impact within weeks, even though it wasn’t the main target. You need to understand how these spillover effects work because your business faces similar risks today.

Taiwan Got Hit by Tariff Spillovers

Trump aimed his tariffs at China, but Taiwan took collateral damage. Why? Because Taiwan’s economy is deeply intertwined with both the US and Chinese supply chains.

Here’s what happened to key sectors:

- Tech companies saw their stock prices swing wildly with every Trump tweet.

- Component manufacturers faced cost increases even on parts not directly tariffed.

- Assembly operations lost orders as US companies scrambled to find new suppliers.

This demonstrates how global trade wars create unpredictable ripple effects, even for countries not directly targeted.

Direct Sector Impacts Hit Hard

Taiwan’s export-heavy industries felt immediate pressure across multiple fronts:

- Electronics and semiconductors faced the biggest uncertainty. These products make up most of Taiwan’s exports, and supply chain disruptions threaten the entire sector.

- Machinery components saw direct cost increases from tariffs on specific parts and materials.

- Petrochemicals faced declining demand as Chinese factories reduced production in response to their own tariff pressures.

- Traditional manufacturing, such as textiles, suddenly found new opportunities as US buyers sought alternatives to China.

Secondary Effects Created New Challenges

The US-China trade war put Taiwan in a unique position. Companies there became potential beneficiaries of supply chain shifts away from China. But they also faced increased scrutiny over their China operations.

This created a double-edged sword: opportunity mixed with political pressure. Taiwan companies had to balance serving both markets while managing the risks of choosing sides.

Trade flow shifts only tell part of the story. Behind the scenes, Taiwan’s government actively worked to stabilize its export base, open alternative markets, and reduce long-term exposure to tariff risks. Understanding these policy choices reveals how Taiwan turned economic pressure into a strategic advantage.

Taiwan’s Negotiation Tactics and Policy Moves

Taiwan didn’t sit back and hope for the best. The government launched an aggressive campaign to protect its economic interests, and you can learn from their approach.

They Engaged Washington Directly

Taiwan’s trade team worked around the clock to secure exemptions. The results prove their strategy worked as key companies got significant tariff relief through smart lobbying.

Here’s how they did it:

- High-level diplomatic missions: Taiwan sent senior officials to Washington for face-to-face negotiations.

- Industry group coordination: Semiconductor and tech associations joined forces to present unified positions.

- Congressional outreach: Taiwan used its bipartisan support in Congress to influence trade policy decisions.

Strategic Messaging Made the Difference

Instead of just asking for help, Taiwan positioned itself as America’s reliable partner. This framing proved crucial when seeking special treatment.

The island emphasized its role as a democratic ally and technology partner. This political messaging became a powerful tool that set Taiwan apart from authoritarian China.

They Built Corporate Allies

Taiwan’s smartest move involved partnering with major US companies that depended on Taiwanese suppliers. When Apple, Intel, and other tech giants faced supply disruptions, they became Taiwan’s advocates in Washington.

These corporate partnerships created powerful lobbying support for maintaining Taiwan’s trade advantages. This approach demonstrates how your customers can become your strongest trade policy advocates.

Looking to bypass delays and middlemen in global logistics?

Reach out to us today!Shifts in Export Strategy and Supply Chain Positioning

When tariff uncertainty hit, Taiwan companies completely transformed their global market approach. You can apply similar strategies to your export operations.

Geographic Diversification Beyond America

Taiwan businesses aggressively pursued new markets to reduce US dependency:

- ASEAN expansion: Companies established partnerships and manufacturing bases across Southeast Asia to serve growing regional demand.

- European market development: Firms expanded European operations using existing trade agreements and market access opportunities.

- Regional partnerships: Japan and South Korea provided alternative revenue streams that reduced dependence on volatile US-China dynamics.

This strategic approach offers important insights: diversifying your export markets reduces dependency risks, regardless of how profitable any single market appears.

Bringing Production Closer to Customers

Taiwan made the boldest move by investing heavily in US manufacturing. TSMC’s Arizona facility exemplifies this strategy, bringing production to customers while avoiding tariff complications entirely.

Other major companies followed:

- Foxconn announced billions in US manufacturing investments.

- Delta Electronics expanded its American production capabilities.

- Quanta Computer established US assembly operations.

This strategy reveals an important principle: sometimes, eliminating tariffs through local production provides better protection than trying to absorb the costs.

Reducing China Dependencies

Taiwan companies systematically reduced their China exposure across multiple areas:

- Supply chain diversification: Moving critical suppliers out of China reduced both tariff risk and political exposure.

- Technology protection: Taiwan strengthened controls after Chinese firms offered engineers up to three times their local salaries to join mainland companies.

- Alternative manufacturing: Companies built production facilities in Vietnam, Thailand, and other countries to maintain access without direct dependencies.

Not every sector adapted the same way. Each had to weigh its exposure, cost structures, and global relevance. Now let’s look at how Taiwan’s core industries responded.

Also Read:Who Pays Tariffs on US Imports? A Detailed Guide

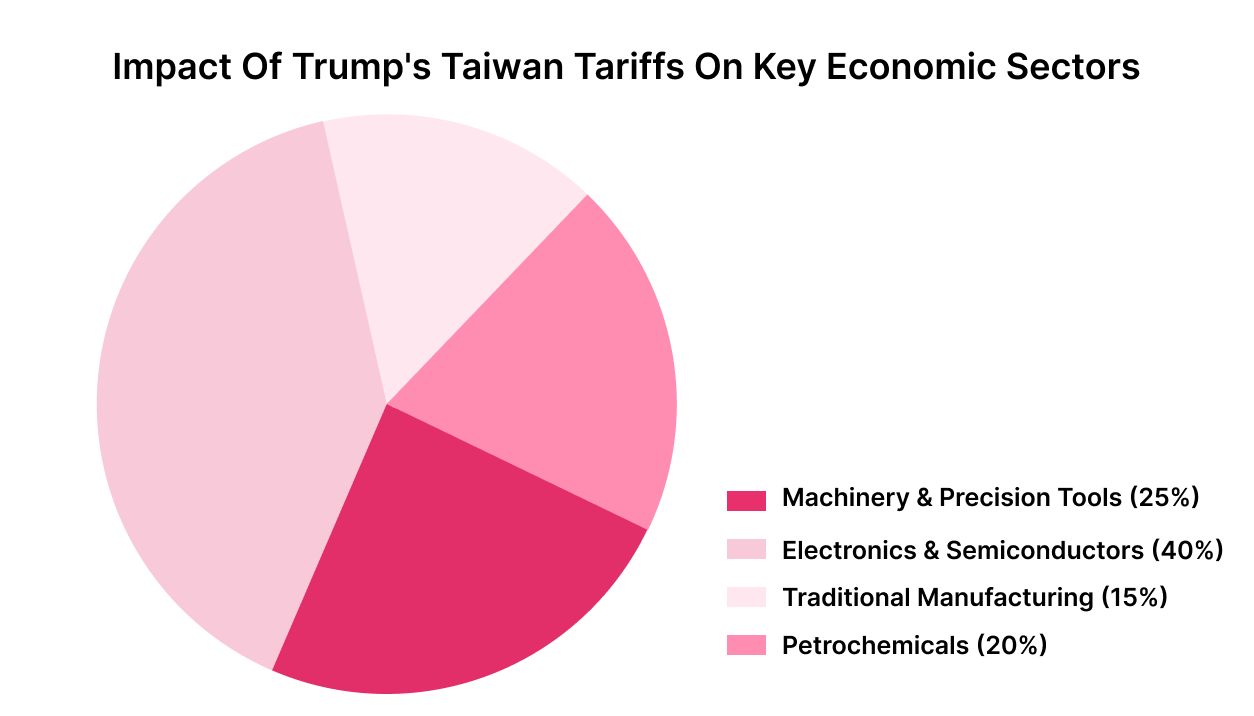

Key Economic Sectors Affected by Trump’s Taiwan Tariffs

Taiwan’s response varied significantly across industries. Understanding these sector-specific strategies helps you develop targeted approaches for managing trade pressures in your industry.

Electronics and Semiconductors

Taiwan’s chip industry represents its economic crown jewel, making protection crucial during trade tensions.

- Market dominance: Taiwan’s semiconductor exports hit $164 billion in 2024, with $85.26 billion going to China and Hong Kong, which is 51.7% of total chip exports.

- Strategic adaptation: TSMC and other leaders accelerated US expansion, building facilities that serve American customers without import complications.

- Innovation investment: Companies doubled down on advanced technologies, maintaining competitive edges through R&D that justifies premium pricing even with tariff pressures.

Machinery and Precision Tools

This sector experienced an immediate impact from Trump’s Taiwan tariff, forcing companies to rethink their entire business models.

- Cost impact: Component-level tariffs increased manufacturing costs for many precision tool makers.

- Value migration: Companies shifted toward higher-value products where tariff costs represented smaller percentages of total value.

- Geographic restructuring: Firms moved assembly to third countries while keeping high-tech manufacturing in Taiwan.

Petrochemicals

The chemical sector faced both direct tariffs and reduced demand from affected Chinese manufacturers.

- Demand collapse: Chinese factories cut production due to tariff pressures, reducing demand for Taiwan’s chemical inputs.

- Market rebalancing: Companies redirected exports toward Southeast Asian markets where industrial demand kept growing.

- Product strategy changes: Firms shifted toward specialty chemicals with higher margins and less price sensitivity.

Traditional Manufacturing

Taiwan’s textile and footwear sectors saw both opportunities and challenges as trade patterns shifted.

- New opportunities: Some manufacturers gained orders as US buyers sought China alternatives.

- Competitive reality: Vietnam and Bangladesh often provided more cost-effective options than Taiwan for basic manufacturing.

- Value addition focus: Successful companies moved toward technical textiles and specialty products, where Taiwan’s capabilities provided real advantages.

While Taiwan’s larger industries adapted through scale and strategy, smaller exporters faced a different reality. It’s just as important to understand how the Taiwanese government stepped in to help these businesses stay competitive through the disruption.

How Taiwan Supported Small Exporters During Tariff Disruptions?

Taiwan recognized that small and medium enterprises needed special help adapting to trade pressures. Their comprehensive support programs provide a valuable framework for engaging with government assistance in your own export operations.

Financial Support Programs Launched Quickly

Taiwan created multiple funding options to help smaller exporters adapt:

- Export credit expansion: The government provided low-interest loans for companies expanding into new markets.

- Market development grants: Small exporters received funding for trade shows, market research, and international business development.

- Technology upgrade subsidies: Companies accessed grants for automation and digitization projects that improved competitiveness despite higher costs.

Digital Transformation Support

Taiwan invested heavily in supply chain technology to help smaller companies compete:

- Connection platforms: Government-sponsored systems connected Taiwanese suppliers with international buyers, reducing dependence on traditional relationships.

- Compliance automation: Automated systems helped smaller companies manage complex documentation for multiple markets.

- Tracking technology: Investment in logistics visibility gave exporters better shipment control, enabling faster response to disruptions.

Trade Promotion and Intelligence Services

Taiwan’s trade councils received expanded resources to guide companies through changing conditions:

- Sector-specific advice: Different industries got targeted guidance based on their tariff exposures and market opportunities.

- Market entry assistance: Councils provided hands-on support for companies entering new countries, including legal and regulatory guidance.

- Competitive analysis: Regular market intelligence helped companies understand how tariff changes affected their positioning.

Compliance and Legal Assistance

Smaller companies often lack resources for complex international trade management, so Taiwan provided centralized support:

- Documentation help: Standardized processes reduced the burden of managing multiple country requirements.

- Legal advisory access: Companies could tap trade law expertise without hiring expensive international firms.

- Dispute mediation: The government provided resolution services for trade-related disputes and compliance challenges.

Need help realigning your exports toward stable, high-demand markets?

Talk to Intoglo for a custom shipping plan!Taiwan’s targeted support for smaller exporters highlights how crucial specialized assistance is during tariff shocks. Indian exporters facing similar hurdles can rely on Intoglo’s direct operations with shipping lines, ensuring faster transit, lower costs, and smoother customs clearance for shipments to the US.

What Indian Exporters Can Learn from Taiwan’s Tariff Response?

Taiwan’s experience provides a proven framework for managing trade pressures and identifying opportunities within policy uncertainty.

Diversification Reduces Your Risk

Taiwan’s rapid market expansion demonstrates practical methods for reducing dependence on single trading partners:

- Build market portfolios: Instead of focusing on one region, develop strong positions across multiple markets.

- Create supplier redundancy: Develop relationships across different countries so you maintain flexibility when conditions change.

- Expand customer bases: Avoid over-concentration with single customers or market segments that policy changes could disrupt.

Proactive Engagement Pays Off

Taiwan’s diplomatic success demonstrates the value of active engagement in trade policy development:

- Form industry coalitions: Work with other companies in your sector to present unified positions on policy issues.

- Partner with government: Engage with Indian trade organizations and diplomatic missions to coordinate market access efforts.

- Activate customer advocates: Build relationships with US customers who can speak up for your interests when policies threaten supply chains.

Technology Investment Creates Competitive Advantages

Taiwan companies’ strategic investments created systems that delivered crucial advantages during trade disruptions:

- Real-time visibility: Tracking and monitoring systems provide clarity during volatile periods when information becomes critical.

- Automated compliance: Systems that handle documentation and regulations automatically become essential when serving multiple markets with different rules.

- Flexible operations: Technology enabling rapid supply chain reconfiguration provides major advantages when trade conditions shift suddenly.

Just as Taiwan’s companies invested in real-time tracking and automated compliance, Indian exporters can benefit from Intoglo’s tech-enabled logistics platform. Features such as Glotrack’s real-time shipment visibility and AI-powered HS code scanningwill help streamline cross-border trade and ensure shipments remain compliant, even in the face of shifting trade policies.

Build Operations That Absorb Tariff Shocks

Taiwan’s experience demonstrates how to develop tariff-resilient business models:

- Focus on value addition: Move toward higher-value products where tariff costs represent smaller percentages of total value.

- Improve operational efficiency: Continuous operational improvement helps maintain competitiveness even when facing additional tariff costs.

- Position strategically: Make yourself an essential partner rather than just another supplier, so customers will absorb some costs to maintain relationships.

Learn From Taiwan’s Challenges

Taiwan’s experience also reveals important pitfalls to avoid:

- Delayed response risks: More than 10 fastener companies in Taiwan closed monthly after tariffs hit. This demonstrates the critical importance of rapid diversification when trade conditions change.

- Currency exposure management: Taiwan’s dollar appreciated during the trade war, creating competitive pressures beyond tariffs.

- Political risk considerations: While Taiwan faces unique political situations, the principles of political risk management apply to all export operations.

Want to simplify U.S.-bound shipping with no surprises or agents?

Contact Intoglo and ship directly!Conclusion

The Trump-Taiwan tariff fallout didn’t slow Taiwan down; it forced a shift. From fast policy moves to strategic export decisions, Taiwan showed how to turn trade pressure into long-term advantage. For Indian exporters watching global tariffs tighten again, the lesson is simple: don’t wait for certainty. Build for resilience now.

That’s precisely where Intoglo comes in. We run direct operations, without agents or third-party layers, so your cargo moves faster, stays compliant, and costs less. Here’s how:

Here’s what you get with Intoglo:

- Door-to-Door Logistics: From factory pickup in India to final delivery across 41,000+ US zip codes, we handle everything, pickup, consolidation, customs, warehousing, and last-mile transport, so your team doesn’t have to juggle multiple vendors.

- Transparent Pricing: Get instant rate quotes with no hidden fees, just straightforward pricing that helps you plan your shipments confidently.

- Warehousing in the USA: Use over 50 US-based warehouses for temporary or long-term storage. We support B2B and D2C needs, with services like unloading, sorting, repacking, and regional dispatch.

- Amazon FBA Shipments: Ship directly to Amazon FBA warehouses. Our team manages palletization, carton labeling, container planning, and full compliance with Amazon’s strict inbound rules.

- Customs Clearance & Compliance: Avoid delays with proactive documentation checks, HS code scanner, and entry processing by licensed brokers, backed by our in-house compliance tech.

- Real-Time Tracking with Glotrack: Track every shipment in one place. Glotrack shows real-time movement, alerts you to exceptions, and stores all key documents for easy access.

For building a tariff-ready supply chain,reach out to Intoglo and see how we keep your shipments fast, compliant, and entirely in your control.

FAQ’s

1. How has Taiwan responded to Trump’s 32% tariffs on its goods?

Taiwan has chosen not to retaliate with tariffs against the U.S. Instead, it formed a negotiation team to pursue talks to lower tariffs to zero, modeled on USMCA, while supporting industries affected by tariffs and expanding U.S. investments.

2. What key strategies is Taiwan using to mitigate the impact of U.S. tariffs?

Taiwan is increasing U.S. energy imports, lowering some domestic tariffs, helping companies relocate investment to the U.S., supporting SME transformation, expanding purchases of U.S. goods, and negotiating tariff reductions to stabilize trade relations.

3. Why is Taiwan avoiding tariff retaliation despite a significant economic impact?

President Lai emphasized Taiwan’s strong economic fundamentals and the importance of maintaining good bilateral relations. Taiwan also benefits from diverse export markets, with over 75% of exports going elsewhere than the U.S., mitigating tariff risks.

4. How is Taiwan aligning its trade policy with broader U.S. interests under Trump?

Taiwan supports U.S. goals like blocking Chinese “origin washing,” boosting U.S. defense purchases, and investing more in U.S. manufacturing. It leverages bipartisan U.S. support, working proactively to deepen ties and align interests with American trade and security priorities.

5. What industries in Taiwan are most affected by the tariffs, and how is the government helping?

Sectors like traditional manufacturing and SMEs face significant impacts. The government plans to provide direct financial support, accelerate industrial transformation focused on semiconductors and smart manufacturing, and aid companies shifting operations to the U.S. to mitigate job and profit losses.

Leave a comment