Unexpected port costs can quietly eat into your margins, especially when you’re shipping full-container loads to the US. One miscalculated storage fee or handling charge, and your shipment profit turns into a loss. Port charges constitute a significant part of ocean freight costs, yet most exporters have no reliable way to predict them.

The Tariff Authority for Major Ports (TAMP) used to directly regulate what India’s major ports could charge for services like berthing dues and cargo handling. But after the Major Port Authorities Act of 2021, that role has shifted; many ports now set tariffs based on market conditions, not TAMP oversight.

This blog breaks down how TAMP functions today, what it still controls, how tariff decisions are made, what’s changing with ongoing reforms, and how to manage port cost volatility when exporting from India to the USA.

Key Takeaways

- Major Indian ports handled 819 million tonnes in FY24, but tariff structures still heavily impact export margins.

- TAMP oversees a port-led model where Boards set rates with greater autonomy.

- Exporters now have more visibility, earlier involvement, and formal recourse in tariff decisions.

- Digital systems like SAGAR SETU and performance-based pricing are reshaping tariff logic.

- Understanding how tariffs are set helps Indian exporters ship smarter, plan better, and control costs.

What Is the Tariff Authority for Major Ports (TAMP) Today?

TAMP serves as a key advisory body in India’s port ecosystem, focused on ensuring fairness, transparency, and accountability in port tariffs. While it no longer fixes rates directly, it plays a crucial role in guiding major ports, especially during the shift to market-driven pricing under the 2021 reforms.

TAMP reviews tariff proposals, consults with stakeholders, and supports compliance with national pricing policies. It also helps resolve disputes between exporters, terminal operators, and port authorities, ensuring that pricing decisions remain transparent and balanced.

By enabling smoother transitions, protecting user interests, and upholding consistency, TAMP continues to strengthen tariff governance even in a decentralized framework.

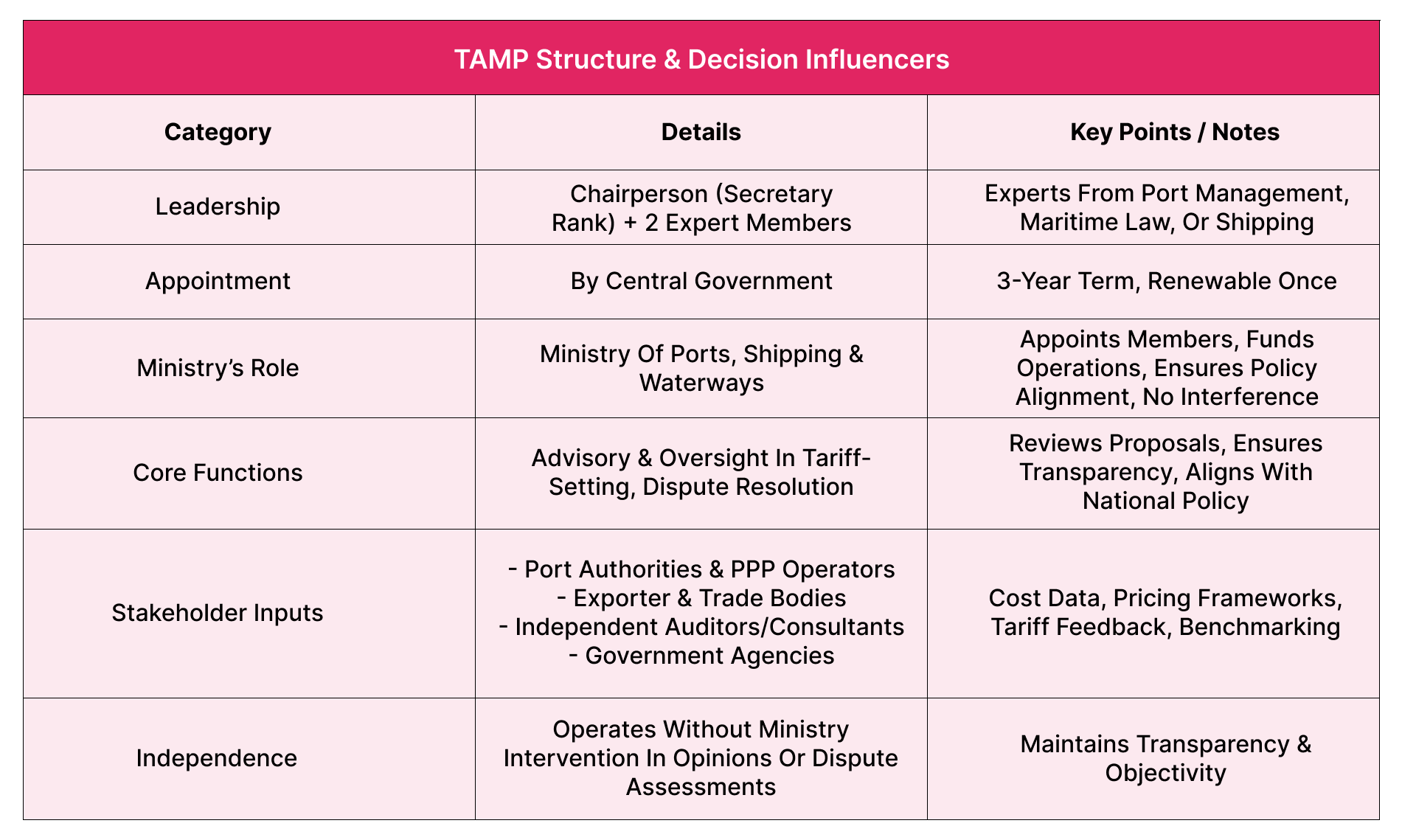

How TAMP Is Structured and Who Influences Its Decisions?

TAMP continues to play an advisory and oversight role in India’s major port ecosystem, especially as tariff-setting becomes more decentralized. To understand how it contributes to fair pricing and policy alignment, it is important to know how TAMP is structured and how its consultative processes work.

Who Runs TAMP and How They’re Appointed

Tariff authority at major ports is led by a small, high-level panel appointed by the Central Government. It includes:

- A Chairperson of the Secretary’s rank

- Two experts from port management, maritime law, or shipping

Members serve three-year terms and may be reappointed once. This lean structure allows the body to review tariff-related submissions efficiently, issue consultative opinions, and assist in dispute resolution when requested.

What Role Does the Ministry Plays

TAMP operates independently, though it receives administrative and financial support from the Ministry of Ports, Shipping, and Waterways.

- The Ministry appoints members and provides funding.

- It ensures policy alignment with broader national objectives.

- It does not interfere with or override TAMP’s consultative opinions or dispute assessments.

This independence helps maintain transparency and objectivity in pricing-related matters.

Who TAMP Listens to Today

Although it no longer sets tariffs, TAMP remains involved in the consultative process by reviewing inputs from:

- Port Authorities and PPP operators sharing cost data and pricing frameworks.

- Trade bodies representing exporters, freight forwarders, and shipping lines.

- Benchmarking consultants and independent auditors.

- National policies influence government agencies in their port operations.

These inputs help TAMP support a more transparent, competitive pricing environment as India’s port sector transitions to performance-based and market-driven models.

Also Read: Impact of Reciprocal Tariffs on International Trade Practices

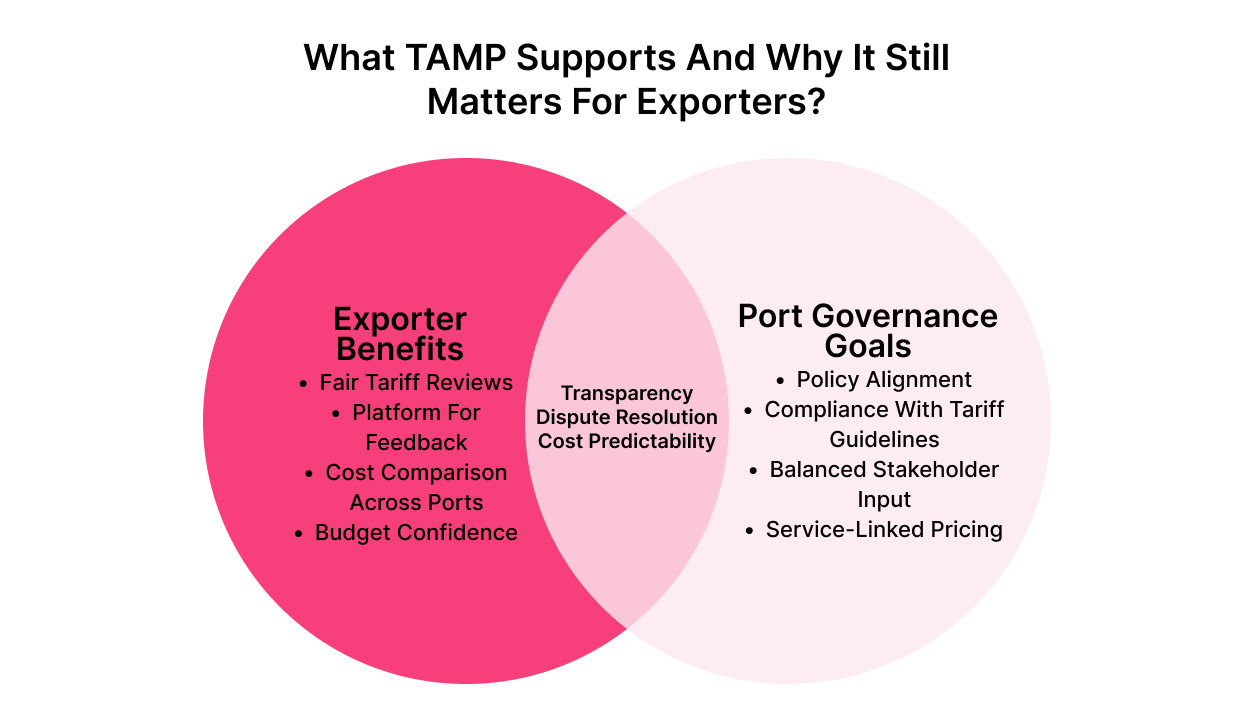

What TAMP Supports and Why It Still Matters for Exporters?

India’s major ports handled 817.98 million tonnes of cargo in FY 2023–24. For exporters operating at this scale, every cost line matters, especially port charges tied to container handling, vessel services, and storage. While individual port authorities now set most tariffs, TAMP remains relevant by keeping the system transparent, consultative, and policy-aligned.

How TAMP Contributes to Pricing Oversight

TAMP supports exporters by:

- Reviewing tariff proposals and cost justifications from major ports.

- Facilitating consultation with port users, including freight forwarders and exporters.

- Advising on compliance with national tariff guidelines.

- Assisting with dispute resolution when pricing disagreements arise.

Its oversight helps prevent arbitrary pricing and ensures port charges remain tied to service-level performance.

Why Exporters Should Still Pay Attention to TAMP

Port costs still account for a significant share of total shipping expenses. TAMP’s role gives exporters:

- A platform for feedback before tariff changes are approved.

- A channel to contest unfair charges through a proper review.

- A consistent policy lens to compare port charges across locations.

- More confidence when quoting freight rates or budgeting for large shipments.

TAMP’s role may be limited, but it still shapes key benchmarks and policy signals that exporters cannot ignore. For businesses managing FCL shipments, platforms like Intoglo help bridge the gap between these frameworks and real-time cost planning.

Struggling to make sense of unpredictable port costs?

Request a Quote from IntogloHow Tariffs Are Set at India’s Major Ports?

Each major port in India now sets its tariffs based on cost structures, volume forecasts, and commercial priorities. This decentralized system supports faster revisions, more responsive pricing, and greater exporter input throughout the process.

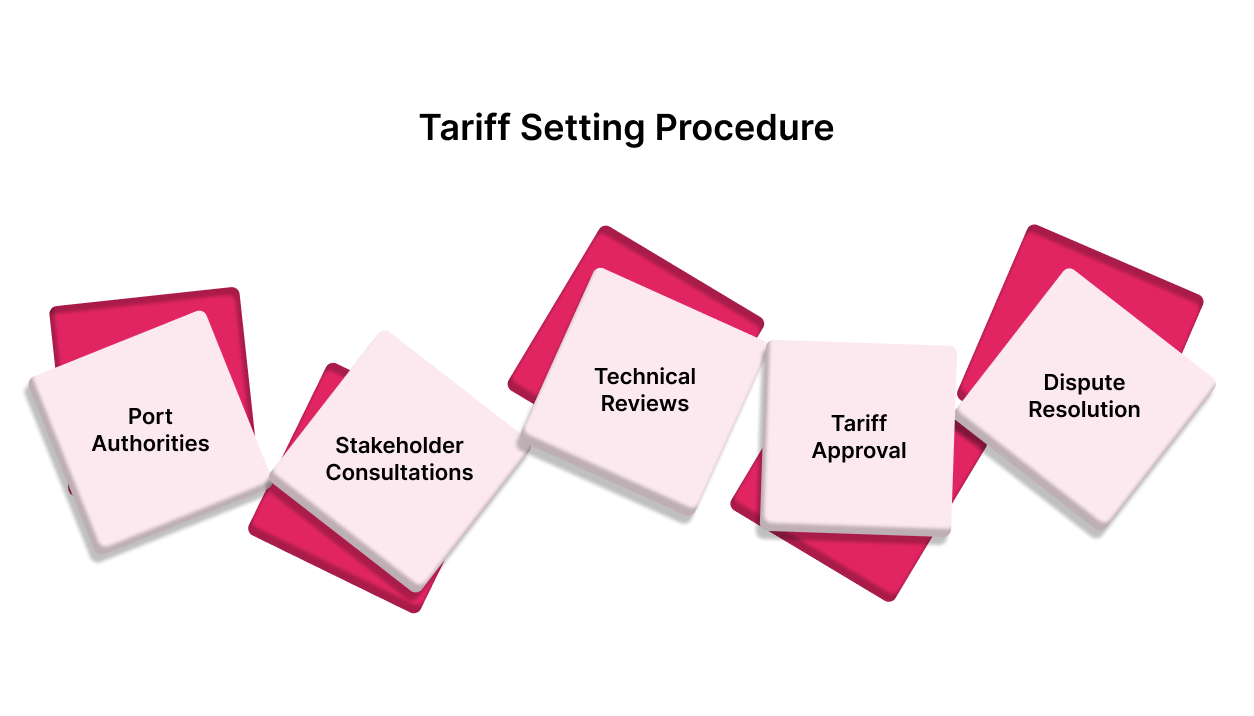

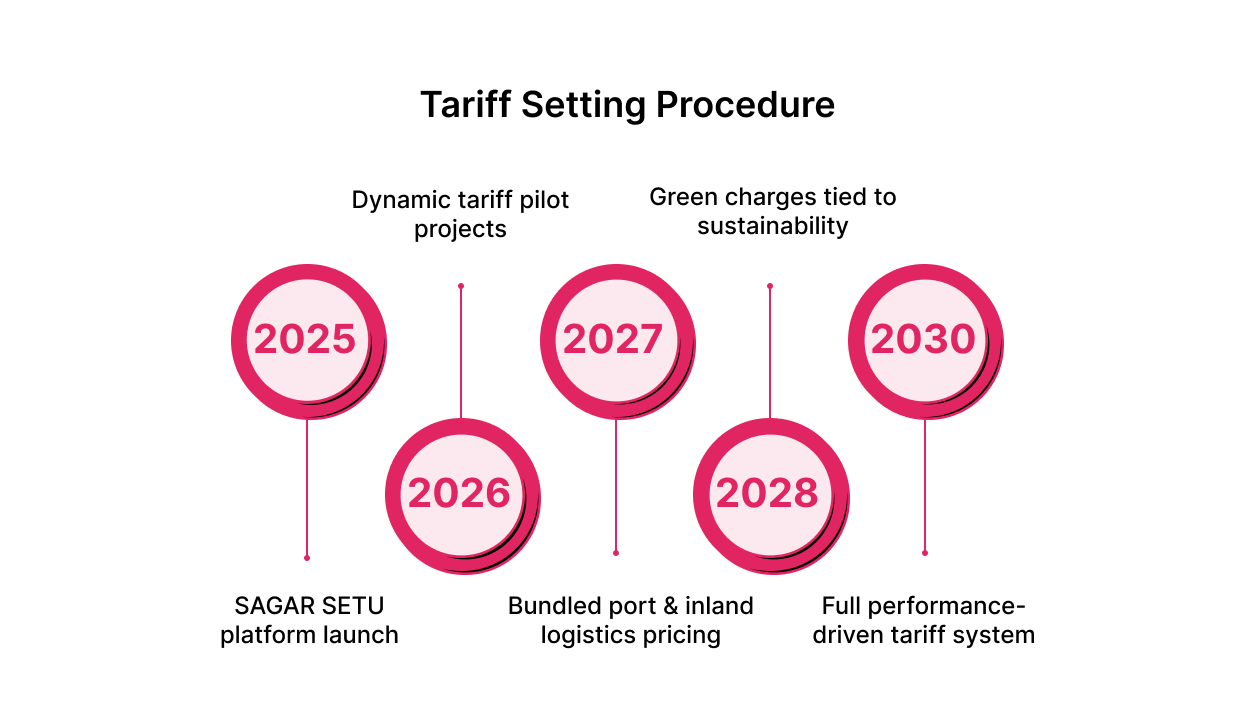

Tariff Setting Procedure

The tariff-setting process now follows a structured, transparent model at the port level. Let us look at how it plays out:

- Port authorities and PPP operators submit tariff proposals with detailed cost justifications, including planned capital investments, operating expenses, and traffic forecasts.

- Stakeholder consultations are held, inviting feedback from exporters, shipping lines, trade associations, and government bodies.

- Technical reviews are conducted, with independent audits or benchmarking studies validating the financial and performance data.

- Port authorities approve tariffs, guided by stakeholder input, cost metrics, and government principles on transparency and fairness.

- TAMP acts as a dispute resolution body, stepping in only when conflicts arise around tariff proposals or implementation; it evaluates claims and delivers binding rulings

Why This Matters for Exporters

Exporters now have more clarity and influence over port tariffs.

- Ports can revise charges in line with market shifts or operational changes.

- Exporters can participate early in the decision-making process.

- Disputes are resolved through a formal, structured mechanism.

Understanding how this process works helps exporters plan and manage shipping costs with more precision.

Want real-time tariff visibility for your next US shipment?

Contact Intoglo today!Challenges in Port Tariff Regulation

TAMP operates in a fast-moving trade environment, but its tariff framework often struggles to keep up. Exporters, especially those using modern logistics systems, face outdated pricing structures, regulatory delays, and limited flexibility at major ports.

Legacy Pricing Models Still in Play

Many ports still use tariff schedules built for labor-heavy, bulk cargo operations.

- Doesn’t reflect automation: Cranes, digital check-ins, and container handling are not priced into older structures.

- Unnecessary cargo distinctions: Tariffs separate goods that are now handled in the same way.

- Slows tech adopters: Exporters using digital workflows do not see proportional cost or time savings.

Private Terminals Resist Central Oversight

TAMP must regulate terminals that prefer market-driven pricing.

- Pushback on uniform rates: Operators want flexibility to compete and price per terminal conditions.

- Cross-port cost gaps: Old vs new ports have different operating realities, but TAMP aims for consistent rules.

- Competitive lag: While private ports change rates fast, TAMP-regulated ports wait months.

Tariff Logic Misaligned with Modern Trade

TAMP focuses on task-level costs, not total shipment efficiency.

- No reward for integration: Exporters investing in end-to-end tech systems pay the same as manual setups.

- Container handling is still under-optimized: Many tariff sheets treat container and break-bulk similarly.

Also Read: Understanding the Difference Between Tariff and Non-Tariff Barriers

How TAMP Influences Port Costs, Delays, and Logistics?

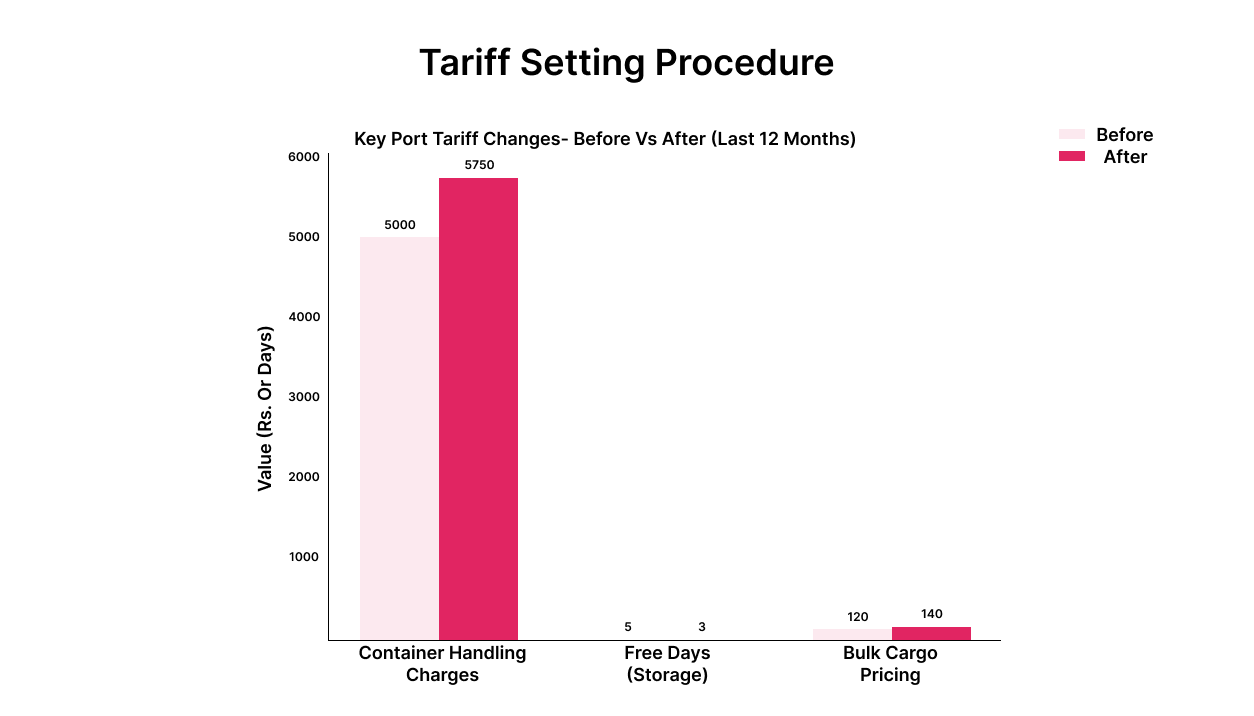

TAMP rulings directly influence your export costs, timelines, and port choices. Every tariff revision brings shifts that you need to account for, sometimes adding to your expenses, sometimes opening new operational advantages. Here is how it plays out on the ground.

Watch for Recent Cost Changes

Tariff updates over the last year have triggered notable shifts at major ports:

- Container handling charges: Some areas, like the Bogda area outside the Customs Bound Area, have a 15% per annum increase to support upgrades. This rise is specific and not uniform across all ports, where charges vary by location and container type.

- Free days: Ports with congestion issues have reduced free storage periods, while more efficient ones have gained flexibility.

- Bulk cargo pricing: New structures are now aligned with cargo type and handling difficulty, especially for minerals, fertilizers, and agricultural products.

Adjust Your Daily Operations

Tighter timelines and higher costs call for better coordination across your logistics:

- Berth delays: Costs increase quickly if documents or clearances are not ready when your vessel docks.

- Handling improvements: Better cranes and digitized systems can reduce turnaround times and offset some of the new charges.

- Storage planning: With reduced free days, you need to time pickups more precisely or face steep warehousing fees.

Choose Ports Based on Cost-to-Benefit Fit

Not all tariff increases are bad; some ports now offer stronger infrastructure or better reliability.

- Total cost comparison: Check not just handling charges, but storage and vessel-related fees to find the most cost-effective port.

- Speed versus price: Faster ports may justify higher charges by reducing vessel idling and improving turnaround.

- Proximity trade-offs: A nearby port with higher tariffs might still be cheaper overall than a distant, lower-cost facility.

Staying ahead of tariff changes demands constant attention to routes, timing, and port costs. Every adjustment can impact your bottom line or open new efficiency gains.

Intoglo supports Indian exporters with real-time port data, cost comparisons, and complete FCL freight services from origin to delivery.

Looking to ship smarter by choosing the right port every time?

Reach out to Intoglo’s freight team!Future of TAMP and Exporter Tariffs

As Indian ports modernize under the Maritime India Vision 2030, TAMP is evolving from a static price regulator to a facilitator of performance-driven, tech-aligned tariff systems. This shift reflects broader trends, private investment, landlord port models, and rising expectations for transparency and efficiency.

For exporters, this means future port costs won’t just depend on cargo volume or vessel type; they will reflect how ports perform, how they are managed, and how much they have invested in digital or green upgrades.

Dynamic Tariffs Based on Utilization and Congestion

Indian port tariff reforms are moving toward more flexible, market-responsive pricing models that adjust to real-time conditions such as congestion, berth availability, and seasonal shipping volumes. While this shift aims to optimize port capacity use and encourage demand balancing, these dynamic tariff structures are currently in developmental or pilot stages at many ports.

In the future, exporters who strategically time their shipments could benefit from lower port dues during off-peak periods. This approach reflects the broader policy goal of making tariffs more aligned with actual market conditions rather than fixed year-round rates.

Bundled Port and Inland Logistics Pricing

With multimodal integration becoming a national priority, TAMP may approve tariffs that group port charges with related services.

- Future pricing may include customs clearance, inland haulage, and terminal handling in one combined rate.

- While easier to manage administratively, bundled pricing requires scrutiny to ensure cost efficiency.

- Encourages better coordination between ports, rail, and road logistics players.

Green Charges Tied to Port Sustainability Measures

Environmental regulations are starting to influence how tariffs are structured, especially at major ports under central control.

- Ports investing in emission control, electrification, or waste processing may introduce new cost components.

- TAMP is reviewing proposals where sustainability-linked charges are tied to specific compliance efforts.

- These fees may rise, but they can also help exporters meet international ESG expectations, particularly for shipments to the US and Europe.

Digitally Driven Ports with Performance-Based Incentives

TAMP and the Ministry of Ports, Shipping and Waterways (MoPSW) are actively promoting operational efficiency through digital transformation initiatives. Key recent developments include:

- The SAGAR SETU platform, launched in June 2025, integrates over 80 ports and 40 stakeholders, enabling smooth, paperless vessel and cargo documentation.

- Establishment of the Digital Centre of Excellence (DCoE) in partnership with C-DAC, aimed at accelerating the adoption of advanced IT solutions like AI, IoT, and Blockchain in port operations, fostering innovation, and steering modernization efforts aligned with Maritime India Vision 2030 and green initiatives.

- Mandatory digital filing, stakeholder consultation, and online publication of all tariff proposals increase transparency and expedite approvals, supporting a data-driven regulatory environment.

These initiatives highlight a government commitment not only to digitize port operations but also to align tariff policies with measurable operational excellence and sustainability goals.

Where Intoglo Comes In

Exporters often lose money at the port. Tariff shifts, unclear pricing, and complex fee structures make it hard to plan costs. Intoglo fixes that with real-time data, accurate breakdowns, and innovative routing tools built for Indian exporters. Below are some of the ways Intoglo can help you:

Tracks Tariffs in Real Time

Intoglo updates TAMP-regulated charges the moment new rates go live. Our system reads your shipment details, including HS Code, and applies the correct wharfage, handling, and documentation fees automatically.

You do not need to check PDFs or track circulars. Every instant rate quote reflects the exact rate for your cargo, container, and schedule.

Breaks Down Every Cost

You see every port charge upfront, no markups or missing fees. From storage to terminal handling, our platform lists it all so you can plan with confidence.

As your shipment moves, Glotrack shows how port costs are building up. You can track demurrage, act early, and avoid avoidable expenses.

Helps You Pick the Right Port

Some ports may appear cheap on paper, but they can end up costing more due to delays or service issues. Intoglo compares all-in costs across ports using tariff data, vessel schedules, and past performance.

You get smart, data-backed suggestions, whether you are shipping to an Amazon FBA warehouse or a B2B customer in the US.

Conclusion

While the Tariff Authority for Major Ports still plays an advisory and dispute resolution role, tariff-setting now lies with individual Major Port Authorities and private terminal operators. For Indian exporters, especially those shipping to the US, staying alert to shifting port charges and performance metrics is crucial. These directly impact overall costs and timelines.

That is where Intoglo helps. From transparent freight quotes and AI-powered HS code scanning to real-time port cost comparisons, Intoglo gives exporters full visibility into tariffs and port efficiency.

Contact Intoglo’s expert team to see how we help you simplify TAMP compliance, optimize port selection, and reduce shipping costs from India to the USA.

FAQ’s

1. What is a port tariff in shipping?

A port tariff is the official schedule of charges levied by a port authority for using port services, including loading, unloading, storage, vessel docking, and documentation, applied to shipping lines, freight forwarders, or cargo owners.

2. What is the difference between major and minor ports in India?

Major ports fall under the central government and handle most of India’s international cargo traffic. State governments manage minor ports and usually handle regional trade, smaller volumes, and limited categories of cargo or vessels.

3. What are the types of ports in shipping?

Shipping ports include seaports for ocean freight, dry ports for inland container handling, and river ports for inland waterways. Each type supports specific cargo movement based on location, vessel type, and infrastructure capacity.

4. How do you determine what ports are in use?

You can identify active ports by checking vessel schedules, customs records, shipping line routings, or trade data. Digital freight platforms and port authorities also publish real-time usage metrics and terminal activity reports.

5. What are the three categories of ports?

Ports are commonly categorized into commercial ports for trade, fishing ports for marine harvesting, and military ports for defense operations. Each serves different functions based on security, economic role, and administrative control.

Leave a comment