When President Trump denied Apple’s tariff waiver requests in 2019, the tech giant faced a critical decision that would reshape global manufacturing. The refusal sent shockwaves through corporate boardrooms worldwide, signaling that even tech giants couldn’t escape the administration’s trade policy agenda.

Fast forward to 2025, and the consequences continue to unfold with remarkable precision. UBS analysts warn that reciprocal tariffs could push iPhone 16 Pro Max prices up by as much as $350 in the U.S., directly affecting consumers and competitors alike.

For managers and business leaders, these changes show how trade rules affect supply chains and the tech industry. Understanding these impacts is important for your business planning.

Key Takeaways

- Tariffs on Apple’s iPhones significantly raise production costs and influence pricing strategies.

- The U.S. tariff waiver denial pushed Apple to rethink its supply chain and manufacturing locations.

- India has become a major hub for iPhone production, helping Apple reduce exposure to high tariffs.

- Tariff exemptions on smartphones are set to expire soon, which may lead to higher prices and operational changes.

- Exporters need flexible supply chains and strong compliance to navigate evolving trade policies effectively.

What Are Tariffs and Why Do They Matter for iPhones?

Tariffs are taxes on imports designed to make foreign goods costlier, prompting companies like Apple to adjust supply chains by relocating production or sourcing components differently to control costs.

For Apple, tariffs hit hard because most of its iPhones are made in China. The company depends on a large network of Chinese suppliers and factories, including big names like Foxconn.

But tariffs do not just apply to the finished iPhone. They also affect important parts like processors, screens, batteries, and cameras, all made or assembled in China. This means Apple’s costs go up at multiple stages of production.

That’s why tariffs matter so much for iPhones. They force Apple to rethink where and how it builds its products.

Current Tariff Structure and Impact on Apple

The current tariff landscape is complex, with rates varying widely depending on where Apple manufactures its iPhones. According to the White House, China faces tariffs as high as 145%, significantly raising Apple’s supply chain costs when producing there.

By contrast, iPhones made in India face a lower tariff rate, while Chinese-produced units currently have a higher tariff. These differences create strong financial incentives for Apple to shift production outside China whenever possible.

Key points to understand:

- India tariffs: iPhone production currently enjoys tariff exemptions following the US administration’s April move to exclude smartphones, computers, and other electronics from reciprocal tariffs.

- Smartphone exemption: Temporarily shields iPhones but expires August 14, 2025.

- Expanding tariff coverage: New rounds affect India, Vietnam, Japan, South Korea, and Taiwan with rates from 24% to 54%.

The smartphone tariff exemption is set to expire soon, creating uncertainty. If not extended, Apple may face immediate cost increases, potentially leading to higher prices or changes in product strategy.

Moreover, tariffs now impact more countries beyond China and the U.S., adding layers of complexity for Apple’s supply chain. While temporary waivers help, the protective framework could change as trade policies evolve.

For Apple, this means:

- Balancing cost pressures from tariffs with operational efficiency.

- Managing risks across multiple countries with varying tariff rates.

- Navigating a volatile trade environment that requires flexible supply chain strategies.

Understanding the current tariff structure is crucial for understanding why the Trump Administration will not waive Apple’s tariffs and why he has taken a firm stance against waiving them. These high and varied rates create significant financial pressures that shape production decisions.

But beyond the numbers, there are deeper political and strategic reasons behind the refusal to grant Apple relief, reasons that reflect broader trade priorities and the push to strengthen domestic manufacturing.

Apple iPhone Tariffs and Trump’s Impact on Prices

President Trump refused Apple’s tariff waiver request for several reasons rooted in both economic and political strategy. First and foremost, he wanted to push American companies to bring manufacturing back to the U.S. His message was clear: companies must produce domestically to avoid tariffs.

But the decision went beyond job creation. At the time, tensions between the U.S. and China were escalating over trade, technology, and national security concerns. The tariffs were part of a broader effort to pressure China and counter its growing economic influence.

Granting Apple a waiver would have undercut that strategy, signaling weakness in the administration’s stance toward China. It would have sent the wrong message to both U.S. businesses and the Chinese government.

Despite Tim Cook’s arguments emphasizing Apple’s US investments and jobs, the administration prioritized its broader trade strategy to encourage domestic manufacturing and counter China’s influence, overriding individual company requests.

The refusal set a precedent that tariffs were not negotiable tools for individual companies but a firm policy to reshape global manufacturing and U.S.-China relations.

Also Read: Impact of Reciprocal Tariffs on International Trade Practices

How Are Tariffs Affecting iPhone Prices?

The tariffs on Apple’s supply chain have a real impact on iPhone prices, corporate strategy, and consumer behavior. Understanding this helps explain why Apple is making significant changes in its operations and pricing.

Potential Price Increases

Apple’s iPhone 16 Pro Max could see price hikes as high as $350. For customers using financing plans, this could mean monthly payments rise by $5 to $8 on a 24-month plan, small enough to go unnoticed initially but significant over time.

Key points on price impact include:

- Up to $350 price increase on iPhone 16 Pro Max.

- $5–$8 more per month for financed devices.

- Price changes affect consumer buying decisions and competitive positioning.

How Apple Is Responding to Tariffs?

Rather than passing costs directly to consumers immediately, Apple has absorbed many tariff-related expenses internally. CEO Tim Cook noted in recent earnings calls that tariffs hadn’t significantly impacted their March 2025 quarter results.

Despite slower upgrade cycles among users, Apple’s iPhone revenue still grew 1.9% year-over-year in Q1 2025. This reflects a delicate balance between maintaining sales volume and protecting profit margins.

Apple’s financials show:

- Component costs for the iPhone 16 Pro are around $568, just over half the retail price.

- This cost structure allows some flexibility to absorb tariffs temporarily.

- Sustained tariffs require broader strategic adjustments beyond cost absorption.

Preparing for the Future: iPhone 17 Launch and Pricing Outlook

Looking ahead, Apple’s upcoming iPhone 17 series, launching in September 2025, is expected to feel the tariff effects clearly. Analysts anticipate price increases across the lineup due to rising production costs and continued tariff pressures.

Estimated price points for iPhone 17 models are:

- iPhone 17: $799.

- iPhone 17 Air: $949.

- iPhone 17 Pro: $1,049.

- iPhone 17 Pro Max: $1,249.

Apple faces tough choices if tariff exemptions expire on August 14, 2025. Potential responses include:

- Increasing retail prices by up to 17% on affected products.

- Reducing product offerings to manage costs.

- Continuing to absorb costs, though this may squeeze profit margins further.

These pricing pressures have accelerated Apple’s supply chain shifts more than any previous trade tensions, marking a new phase in how the company manages global manufacturing.

Worried about how tariffs affect your export costs?

Contact Intoglo!Rising tariffs have forced Apple to absorb increased costs so far, but this strategy has limits. As tariff exemptions near expiration and price pressures mount, especially with the upcoming iPhone 17, Apple faces critical decisions. These challenges are driving the company to rethink its supply chain and manufacturing approach, setting the stage for significant strategic changes.

How Has Apple’s Strategy Changed Since the Tariff Decision?

In response to escalating trade tensions and tariffs, Apple has significantly altered its supply chain strategy. The company has implemented a series of strategic initiatives to mitigate risks and adapt to the evolving global trade environment.

1. “China Plus One” Strategy: Diversifying Production Hubs

Apple has adopted the “China Plus One” strategy, aiming to reduce its reliance on Chinese manufacturing by establishing alternative production sites. This approach involves expanding operations in countries like India and Vietnam to diversify its supply chain and mitigate geopolitical risks.

2. Expansion of Manufacturing in India

India has become a central hub for Apple’s production, particularly for iPhones destined for the U.S. market. The company has invested in scaling up manufacturing capabilities in India, aiming to produce the majority of U.S.-bound iPhones there by the end of 2026. This move is part of Apple’s broader strategy to strengthen its manufacturing footprint outside China.

3. Strengthening U.S. Manufacturing Capabilities

In response to domestic policy pressures, Apple has announced a substantial increase in its U.S. manufacturing investments. The company plans to invest $100 billion to bolster its domestic production capabilities, including the construction of new facilities and the expansion of existing ones. This initiative aligns with the U.S. government’s push to strengthen national economic and manufacturing security.

4. Adoption of Advanced Manufacturing Technologies

Apple is investing in advanced manufacturing technologies to enhance production efficiency and reduce costs. This includes the development of AI-driven manufacturing processes and the establishment of research and development centers focused on innovation in manufacturing techniques. These efforts aim to maintain Apple’s competitive edge in the global market.

Apple’s strategy now focuses on building a flexible, resilient supply chain by expanding beyond China. This approach helps manage tariffs and geopolitical risks and lays the groundwork for growth in emerging production hubs.

A key part of this shift is India’s rapid rise as a major manufacturing center. Understanding what drives this growth reveals why India is becoming vital to Apple’s global supply chain.

Planning to diversify your supply chain like Apple?

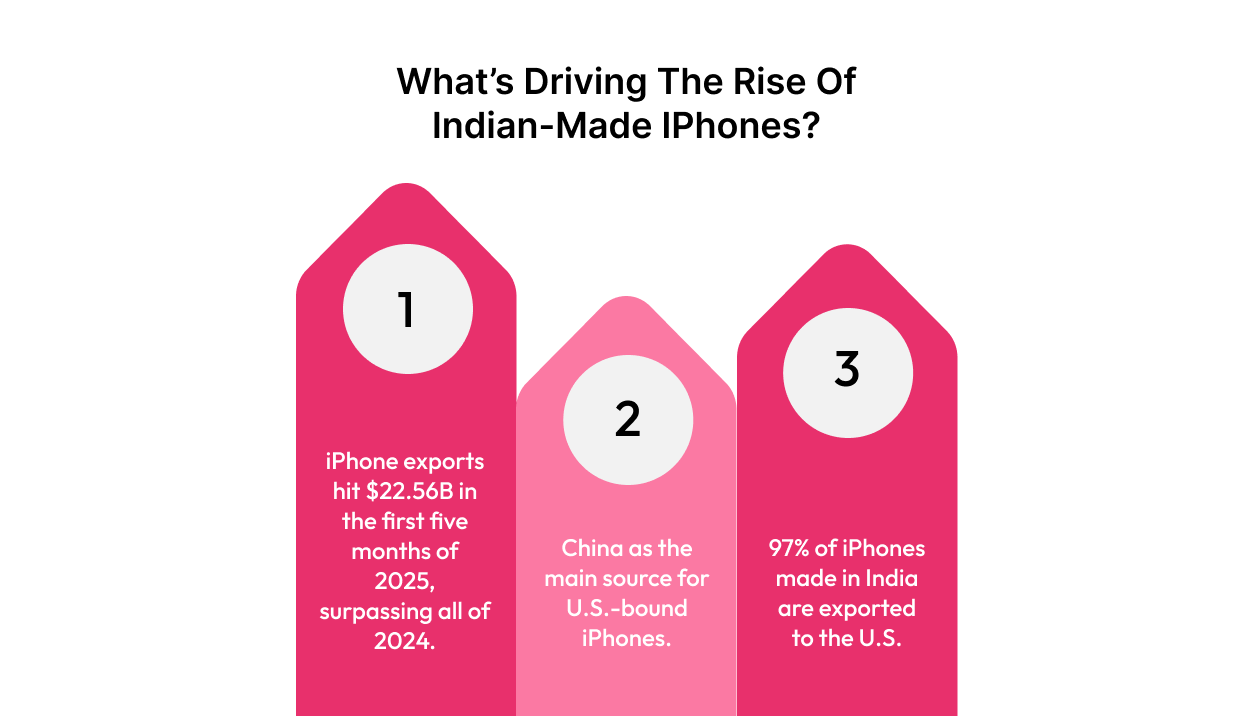

Request a quote from Intoglo!What’s Driving the Rise of Indian-Made iPhones?

India has emerged as Apple’s most significant manufacturing hub outside China, thanks to coordinated government policies, strategic corporate planning, and supplier development. The pace and scale of this transformation have surpassed industry expectations.

Analysts have reported that India accounted for 16-17% of global iPhone shipments in 2025, with projections rising to 20–25% by 2024. Foxconn’s target of producing 25–30 million units in India by 2025 further cements India’s growing role.

Key indicators of India’s rapid rise include:

- Exported over $22.56 billion worth of iPhones in the first five months of 2025, exceeding the total for 2024.

- Officially overtook China as the main source for U.S.-bound iPhones.

- 97% of iPhones manufactured in India are destined for the American market.

Government Policy and Incentives

India’s Production-Linked Incentive (PLI) scheme provides financial rewards to companies based on production volume, helping offset setup costs and encouraging large-scale electronics manufacturing growth.

- Offering performance-based financial incentives to offset setup and operational costs.

- Streamlining approvals for large electronics projects to reduce bureaucratic delays.

- Establishing Special Economic Zones (SEZs) like Sriperumbudur and Oragadam in Tamil Nadu has boosted industrial growth. The state is now a central electronics hardware hub, recording exports worth $14.65 billion in FY 2024–25.

Export Performance and Market Dynamics

India’s export performance reflects a robust manufacturing ecosystem, with iPhone exports to the U.S. increasing over 53% in the first half of 2025 despite trade tensions. Market shares in Indian iPhone production are split as follows:

- Foxconn holds a significant share.

- Tata is rapidly expanding its presence.

- Pegatron controls a notable portion.

Despite progress, challenges remain in matching China’s manufacturing efficiency. India and Vietnam face issues such as yield variations, quality control, and higher short-term costs. Continued investments and development will be essential to reach full parity.

Opportunities and Challenges for the Indian Export Ecosystem

Apple’s manufacturing expansion creates opportunities across India’s export ecosystem, benefiting:

- Component manufacturers.

- Packaging suppliers.

- Logistics providers.

- Support service companies.

For Indian manufacturers, mastering U.S. export requirements is critical. Navigating customs clearance, shipping logistics, and regulatory compliance demands partnerships with specialists experienced in cross-border trade.

This is where Intoglo stands out. By operating directly with shipping lines and avoiding intermediaries or agents, Intoglo offers greater transparency, faster service, and cost savings through a full suite of solutions, including ocean freight, door-to-door logistics, warehousing, Amazon FBA shipments, customs clearance, shipment visibility, and insurance. Their expertise also supports D2C brands and Amazon FBA sellers, helping them efficiently manage complex shipping and compliance challenges unique to these business models.

Ready to scale your exports with reliable logistics?

Reach out to us!When Could Tariff Policies on Apple Shift in the Future?

Trade policies are constantly evolving, shaped by political priorities, economic ties, and global supply chain realities. While current tariffs serve specific goals, future administrations may shift approaches based on changing diplomatic or financial agendas. The immediate concern is that the expiration of smartphone tariff exemptions on August 14, 2025, could trigger rapid price increases.

Key factors that could influence future tariff policies include:

- Political and Economic Priorities: Future leaders may focus on issues like climate change, labor standards, regional partnerships, or technology competitiveness, all of which could reshape tariff rules. Political uncertainty and shifting rhetoric add volatility, with any change in leadership potentially altering exemptions, rates, or regulations.

- Diplomatic Relations and Trade Tensions: Improved relations with key trading partners could lead to tariff reductions or expanded exemptions. Conversely, rising tensions might increase tariffs or broaden product coverage.

- Industry Pressure and Economic Impact: Businesses lobby for policy changes when tariffs hurt consumer prices, jobs, or market competitiveness. Policymakers weigh economic data on inflation, investment, and international trade to balance strategic goals with trade impacts.

- Supply Chain Diversification: As companies spread production across multiple countries, the influence of any one nation’s tariffs weakens. This complexity pushes toward more sophisticated regulations that consider multi-country manufacturing processes rather than simple country-of-origin rules.

Tariff policies are set to change soon, and how they shift will directly impact Apple’s costs and production decisions. These upcoming changes will also reshape the playing field for Indian exporters, opening new possibilities for those prepared to navigate the shifting trade environment.

Also Read: Top Indian Products Exported to USA by Walmart

How Apple’s Tariff Challenges Shape New Opportunities for Indian Exporters?

The Apple tariff story shows how quickly trade policies can reshape global manufacturing, and what that means for Indian exporters and logistics professionals.

These shifts create real opportunities in cross-border trade, but success depends on more than just selling products overseas. To thrive, Indian exporters must:

- Build flexible supply chains that can adjust to changing trade rules and geopolitical risks.

- Develop strong compliance capabilities to meet complex customs and regulatory requirements.

- Partner with experienced logistics providers who operate directly with shipping lines and understand cross-border complexities.

- Invest in multi-country operations to reduce dependency on any single market or supply chain node.

With tariff exemptions expiring and new trade policies on the horizon, the ability to adapt quickly is becoming essential.

For businesses preparing to grow in this environment, the strategic priorities are clear: build resilient supply chains, ensure full compliance, and work with logistics partners equipped to navigate evolving trade policies.

Here’s how a modern logistics partner like Intoglo supports exporters facing these challenges.

How Intoglo Supports Indian Exporters to the USA?

Intoglo is a technology-driven digital freight forwarder offering end-to-end solutions that simplify shipping from India to the USA. Their services cover every stage of the export journey, explicitly designed for MSMEs, D2C brands, Amazon FBA sellers, and large enterprises.

- Ocean Freight (FCL Shipping): Direct, cost-effective full container load shipping with special contract rates from major shipping lines such as Maersk, MSC, and CMA CGM. No intermediaries ensure faster service, lower costs, and transparent pricing with instant online quotes.

- Door-to-Door Logistics: Complete management from warehouse pickup in India to final delivery in the USA, including container stuffing, customs clearance, and trucking across 41,000+ U.S. zip codes.

- Warehousing in the USA: Access to 50+ warehouses for flexible storage solutions, transloading, sorting, and tailored fulfillment for both B2B and D2C operations.

- Amazon FBA Shipments: Specialized services for Amazon sellers with direct deliveries to Amazon warehouses, compliant packing, and expert guidance from in-house Amazon logistics professionals.

- Customs Clearance & Compliance: Experienced customs brokers handle regulatory compliance and clearance at Indian and U.S. ports, supported by AI tools for HS code classification and pre-shipment screening.

- Technology & Shipment Visibility: Glotrack platform offers real-time end-to-end shipment tracking, proactive alerts (including WhatsApp), and centralized document access, backed by 24/7 support.

- Insurance & Value-Added Services: Marine insurance options, extended free days at ports, and custom solutions with instant rate quotes for expedited or specialized shipments.

By partnering with Intoglo, Indian exporters gain a reliable, transparent, and tech-enabled logistics solution, positioning them to meet the challenges of evolving global trade policies confidently.

Conclusion

The reality that Apple will not have tariffs waived under Trump’s policies highlights the tough trade practices exporters face today. For Indian exporters ready to adapt quickly and stay compliant, new opportunities are opening up in global markets.

Success belongs to those who move fast, manage costs carefully, and build strong partnerships. That’s where Intoglo comes in. As a digital freight forwarder focused on India-to-US shipments, Intoglo simplifies your cross-border logistics so you can focus on growth.

Contact us to get started on your next shipment and stay ahead in a changing trade environment.

FAQ’s

1. Have tariffs affected iPhone prices?

Tariffs increased Apple’s production expenses, which gradually raised iPhone prices worldwide. These higher costs influenced pricing strategies, encouraged supply chain adjustments, and pushed the company to explore alternative manufacturing hubs to limit future price volatility for consumers.

2. Did Apple warn that $900 million tariff impact would cause shares to fall?

Apple projected a $900 million tariff impact, raising investor concerns. Despite market volatility, shares recovered as the company implemented cost-absorption strategies, diversified suppliers, and maintained steady revenue growth during challenging trade conditions, easing fears of prolonged financial damage.

3. Why have iPhone prices increased?

iPhone prices rose due to higher component costs, increased labor rates, and supply chain shifts. Tariffs added pressure by raising import expenses, prompting the company to adjust retail prices to protect margins while keeping competitive positioning in global markets.

4. Are Apple iPhones made in China?

Apple manufactures many iPhones in China due to advanced infrastructure, skilled labor, and established suppliers. However, the company is expanding production into countries like India and Vietnam to reduce dependency, mitigate risks, and adapt to shifting global trade policies.

5. Why is Apple exempt from tariffs?

Apple benefits from temporary tariff exemptions on certain electronics, granted by trade authorities to protect consumer affordability and business competitiveness. These exemptions are set to expire soon, potentially increasing import costs and prompting strategic shifts in production and sourcing.

Leave a comment