If you’re curious about what Indian products make it to Walmart’s shelves in the USA, you’re looking at a story of scale and diversity. Walmart has sourced over $30 billion worth of Indian goods in the past two decades and aims to triple its annual exports from India to $10 billion by 2027.

This growth covers everything from apparel, homeware, and jewelry to food, health, wellness, and general merchandise. In 2024, Indian exports to the USA reached $79.44 billion, led by electricals, gems, pharmaceuticals, and auto parts.

In the article, we will explore the top Indian products exported to the USA by Walmart, highlighting key categories and the opportunities they create for Indian manufacturers and American consumers alike.

TL;DR

- Walmart plans to source $10 billion annually from India by 2027, with top export categories including electronics, jewelry, and pharmaceuticals.

- Reciprocal tariffs and trade complexities are reshaping global supply chains, especially for Indian exporters.

- Indian MSMEs and exporters are benefiting from Walmart Vriddhi, which boosts export opportunities.

- India’s exports to the USA reached $79.44 billion in 2024, and the trend is growing.

- Intoglo provides end-to-end logistics solutions to simplify the export process to the USA.

Top Indian Products Exported to the USA

Here’s a detailed look at the top Indian products exported to the USA by Walmart in 2024 and 2025, including their shipment values and projections:

| Product Category | 2024 Export Value (USD) | Key Indian Suppliers/Brands | Notable Trends & Insights |

| Electrical & Electronic Equipment | $12.33 billion | Havells, Dixon, Bajaj, Voltas | High demand for consumer electronics, smart devices, and components; Walmart expanding supplier base. |

| Pearls, Precious Stones, Metals, Coins (Jewellery) | $9.15 billion | Titan, Kalyan Jewellers, Malabar | US consumers show increasing interest in Indian gold, diamond, and silver jewelry; focus on ethical sourcing. |

| Pharmaceuticals | $8.72 billion | Sun Pharma, Dr. Reddy’s, Cipla | India remains the top supplier of generics; Walmart prioritizes affordable healthcare and compliance. |

| Machinery & Nuclear Reactor | $6.48 billion | Bharat Forge, Motherson Sumi | Growth in EV components and precision parts; Walmart targeting cost-effective, quality Indian suppliers. |

| Mineral Fuels, Oils, Distillation Products | $4.38 billion | Reliance, Indian Oil, BPCL | Petroleum oils, distillation products, and petroleum coke are key exports; steady US demand. |

Walmart is on track with a focus on scaling categories like apparel, food, pharmaceuticals, and homeware. Hundreds of Indian suppliers have joined Walmart Marketplace, many experiencing double-digit growth in export volumes in 2025. Over 70,000 MSMEs have been trained under Walmart Vriddhi, and Walmart plans to empower 100,000 more by 2028, further boosting export capacity and product diversity.

Exporters can find the HS Codes for various products on the following pages:

- For Pearls, Precious Stones, Metals, and Coins (Jewellery), visit: HS Code for Jewellery.

- For Mineral Fuels, visit: HS Code for Mineral Fuels.

For a comprehensive list of HS Codes across more product categories, exporters can explore: HS Code Tariff List.

Looking to avoid tariff delays and ensure smooth delivery?

Request a quote from Intoglo!Beyond individual product categories, India–USA trade is evolving with broader trends and policy shifts that open new doors for exporters. Here’s what the future holds.

Emerging Trends and Future Opportunities in India–USA Trade

India-USA trade is entering a transformative phase, driven by new agreements, evolving supply chains, and ambitious growth targets. In FY25, bilateral trade reached $131.84 billion, with India’s exports to the US rising 11.6% to $86.51 billion and a trade surplus of $41.18 billion. As both countries work towards a more balanced partnership, several trends and opportunities are coming into focus.

Key Trends Shaping Trade

- Bilateral Trade Agreement (BTA):

A major BTA is expected by September 2025, aiming to reduce tariffs and open new sectors for collaboration. This will likely benefit US exporters in energy, agriculture, and tech, while increasing competition for Indian exporters. - Mission 500:

Both nations have set an ambitious goal to expand bilateral trade to $500 billion by 2030, signaling a long-term commitment and deeper economic ties. - Tariff Pause:

The US has temporarily paused a proposed 26% tariff hike on Indian goods, giving Indian exporters a crucial window to adapt and strategize.

Future Opportunities for Indian Exporters

- PLI Scheme & Investments:

India’s Production Linked Incentive (PLI) scheme is attracting US investments in manufacturing, green energy, and digital sectors. - Growth Sectors:

- Pharmaceuticals & Healthcare: Rising US demand for affordable generics and wellness products.

- Semiconductors & Electronics: Increasing US focus on supply chain resilience.

- Renewable Energy: New opportunities in solar, wind, and green tech.

- Digital Services: Expansion of IT, fintech, and digital consulting exports.

- Increased Competition:

As tariffs fall, Indian exporters should prepare for greater competition from the US and other global players in the American market.

To tap into these growing opportunities, Indian exporters need more than great products—they need a solid game plan tailored to the US market.

Suggested Read: A Guide on Export Tariff Regulations and Policies

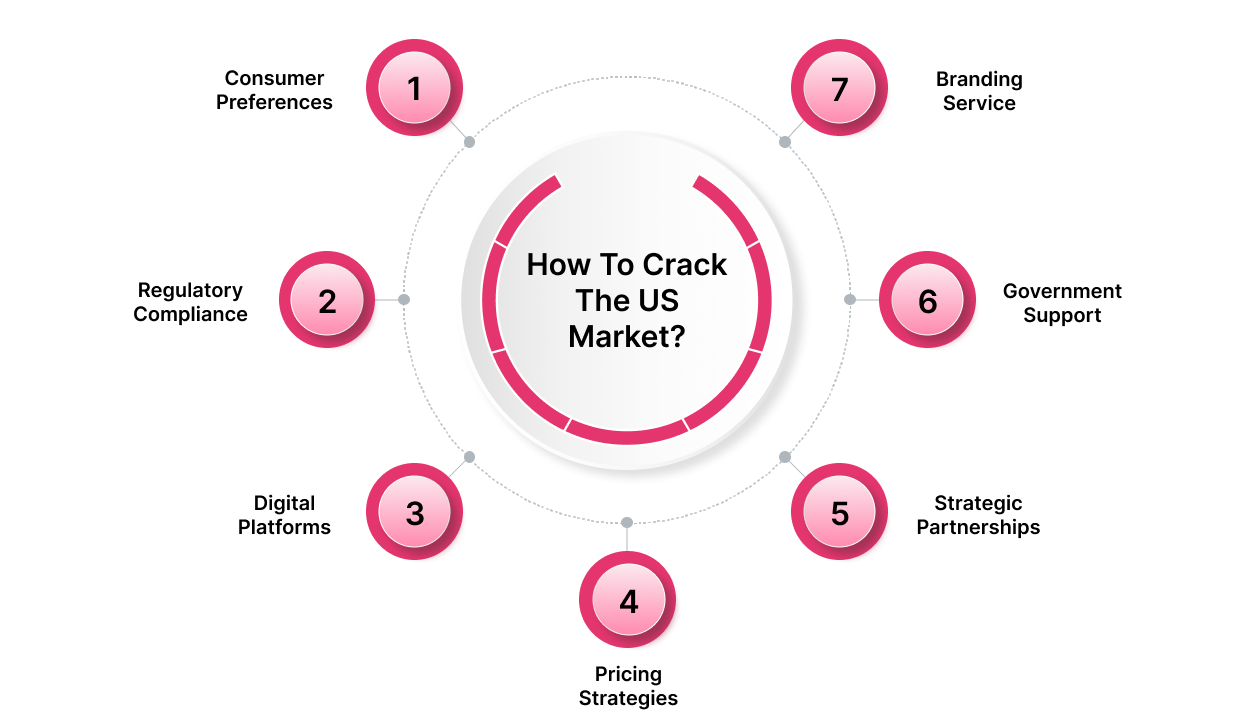

How to Crack the US Market?

Breaking into the US market takes more than just a good product—it demands a smart strategy, regulatory readiness, and leveraging every available support. Here’s how you can boost your export success:

1. Understand US Consumer Preferences

- Target high-demand categories: sustainable goods, wellness, authentic snacks, and tech innovation.

- Invest in market research to stay ahead of evolving trends.

2. Meet Regulatory and Quality Standards

- Ensure compliance with US regulations (FDA, USDA, etc.) and secure all required certifications.

- Maintain transparent documentation and consistent product quality to win buyer trust.

3. Leverage Digital and Retail Platforms

- Use Walmart Marketplace, Amazon, and other US e-commerce channels to broaden your reach.

- Build a robust digital presence and invest in targeted digital marketing for brand visibility.

4. Optimize Pricing and Tariff Strategies

- Stay updated on tariff changes—US tariffs on Indian goods currently stand at 26% as of April 2025, but India has a pricing edge over China and Vietnam.

- Consider hybrid sourcing or value addition in the US to mitigate tariff impact.

5. Build Strategic Partnerships

- Collaborate with US-based distributors, agents, or logistics partners for smoother entry and distribution.

- Explore local warehousing or joint ventures for faster delivery and market adaptation.

6. Tap Government Support and Incentives

- Utilize Indian export promotion schemes and stay informed about bilateral trade agreements for benefits and incentives.

- Some of the programs are Ubharte Sitaare Programme, Credit Linked Capital Subsidy Scheme (CLCSS) & Interest Equalisation, Remission of Duties and Taxes on Exported Products, etc.

7. Invest in Branding and After-Sales Service

- Differentiate your products with strong branding, packaging, and storytelling.

- Set up responsive after-sales support to boost customer satisfaction and retention.

While the path to US success is promising, it’s not without its challenges. Let’s explore the common hurdles Indian exporters face and how to navigate them.

Ready to streamline your India-to-USA exports with expert logistics?

Contact Intoglo today!Suggested Read: List Of Major Petroleum Products Exported From India

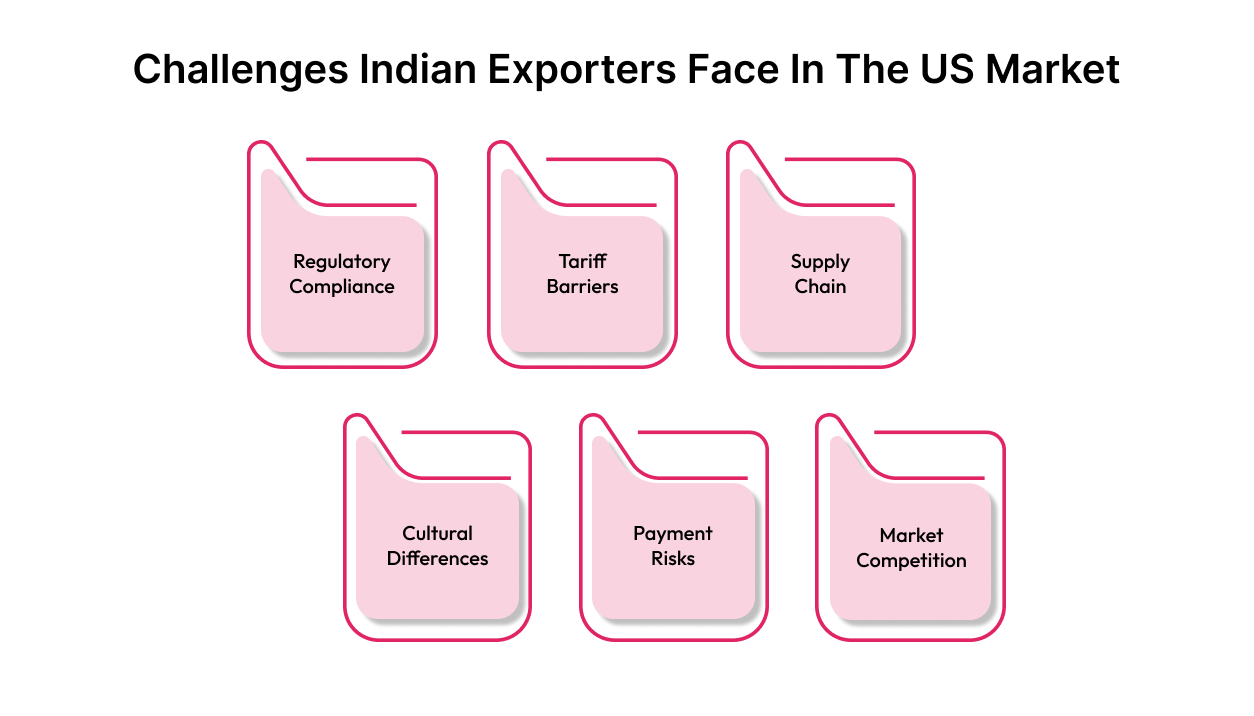

Common Challenges Faced by Indian Exporters in the US Market

While the US market offers vast opportunities, Indian exporters often encounter several challenges that can impact their success. Being aware of these hurdles helps you prepare better and avoid costly mistakes.

1. Regulatory Complexity and Compliance

- Navigating US regulations such as FDA approvals, USDA standards, and customs documentation can be time-consuming and costly.

- Non-compliance risks product rejection, delays, or penalties, affecting reputation and profitability.

2. Tariffs and Trade Barriers

- Despite recent pauses, US tariffs on Indian goods remain high (around 26% in many categories), impacting pricing competitiveness.

- Understanding tariff classifications and leveraging trade agreements is critical to minimizing costs.

3. Logistics and Supply Chain Challenges

- Long transit times, customs clearance delays, and high freight costs can disrupt timely deliveries.

- Managing reverse logistics and returns adds complexity, especially for perishable or fragile goods.

4. Cultural and Market Differences

- US consumer preferences, packaging standards, and marketing styles differ significantly from India.

- Misunderstanding these nuances can lead to poor product acceptance or brand disconnect.

5. Payment and Financial Risks

- Exporters face risks related to payment delays, currency fluctuations, and credit defaults.

- Securing reliable payment mechanisms and trade finance support is vital.

6. Intense Competition

- The US market is highly competitive, with established domestic and global players.

- Differentiating your product and maintaining consistent quality is essential to gaining market share.

By recognizing these challenges upfront, you can develop targeted strategies, such as investing in compliance expertise, partnering with experienced logistics providers, and leveraging government support, to navigate the US market more effectively.

CTA: Need help with customs clearance and shipping to the USA?\

To overcome these challenges and scale efficiently, partnering with an expert logistics provider like Intoglo can make all the difference. Here’s how Intoglo simplifies your export journey.

How Intoglo Helps Indian Exporters Succeed in the US Market?

When it comes to overcoming the logistical and compliance challenges of exporting to the US, Intoglo stands out as a trusted partner for Indian exporters. As a new-age digital freight forwarder, Intoglo specializes in seamless door-to-door FCL shipments from India to the USA, handling every step, from origin pickup to last-mile delivery, so you can focus on growing your business.

What Sets Intoglo Apart?

- End-to-End Control & Visibility: Intoglo manages origin pickup, CFS operations, customs clearance at both ends, ocean freight, and last-mile delivery to over 41,000 US zip codes.

- Tailored Solutions for Every Exporter: Whether you’re shipping for Walmart, Amazon FBA, or direct to US retailers, Intoglo customizes logistics to fit your requirements, including pre-screening, customs entry before arrival, and PAN-USA drayage.

- AI-Powered HS Code Scanner: We provide HS Code scanner for exporters, which allows you to get US-specific HS Code in just two clicks.

- PAN India Reach & Fast Pickup: With pickups from anywhere in India within 24 hours and dedicated CHAs at all major ports and ICDs, Intoglo ensures your cargo moves quickly and efficiently.

- Direct Operations, No Middlemen: By working directly with major shipping lines, US customs brokers, and trucking partners, Intoglo eliminates delays and extra costs, delivering transparent quotations with clear cost breakdowns.

- Expert Customs Compliance: Intoglo’s in-house compliance team and expert customs brokers help you navigate complex US and Indian regulations, reducing the risk of delays, fines, or rejections.

- Warehousing & Distribution Solutions: With 50+ warehouses across the US, Intoglo offers next-gen warehousing, transloading, repacking, and relabeling services, plus dedicated facilities for long-term storage and D2C fulfillment.

- Flexible & Cost-Effective Shipping: Benefit from special contract rates, multiple routing options, and 10 free days at US ports with premium shipping lines. Intoglo’s direct rate procurement ensures you always get the best deal for your shipping needs.

Want real-time tracking for your shipments?

Reach out to Intoglo!Our expertise in cross-border logistics, combined with a strong US network, helps Indian exporters of all sizes, from MSMEs to large enterprises, streamline their supply chain, reduce costs, and deliver reliably to the American market.

Conclusion

Walmart’s commitment to source $10 billion annually from India by 2027 is transforming the presence of Indian products in the US, from festive snacks by Britannia and Bikano to premium textiles, jewelry, and homeware. This surge in exports is not only opening new avenues for Indian brands but also empowering MSMEs and established exporters to reach millions of American consumers through Walmart’s extensive retail and online network. As Indian suppliers continue to diversify their offerings and adapt to evolving US market trends, the opportunities for growth are unprecedented.

If you’re ready to expand your exports to the US, Intoglo can make your journey seamless. With end-to-end logistics, expert customs support, and real-time tracking, Intoglo helps you overcome shipping and compliance hurdles, so you can focus on scaling your business.

Get in touch for a free consultation with our FCL shipping experts and learn more about the in-demand products and how the shipping process works.

FAQs

1. What are the top Indian products exported to the USA by Walmart?

A. Walmart sources a wide range of Indian products, with top export categories including electrical and electronic equipment, jewelry, pharmaceuticals, machinery and auto parts, and mineral fuels. Apparel, homeware, and packaged food items are also significant contributors.

2. Why is Walmart increasing its sourcing from India?

A. Walmart aims to diversify its supply chain, lower costs, and tap into India’s large pool of competitive, high-quality manufacturers. It has committed to sourcing $10 billion annually from India by 2027, driven by growing demand in categories like textiles, healthcare, and electronics.

3. How do Indian exporters benefit from supplying to Walmart in the USA?

A. Indian exporters gain access to a massive retail market, long-term business opportunities, and visibility on Walmart’s online and offline platforms. Many also benefit from programs like Walmart Vriddhi, which supports MSME training and growth.

4. What challenges do Indian exporters face when exporting to the USA?

A. Exporters often face hurdles such as strict US regulatory compliance (FDA, USDA, etc.), high tariffs, shipping delays, and intense market competition. Understanding buyer preferences and investing in quality and branding are key to success.

5. How can Indian businesses start exporting to Walmart in the USA?

A. Businesses can apply through Walmart Marketplace, partner with sourcing agents, or work with export logistics experts like Intoglo to manage customs, compliance, and shipping. Ensuring product readiness and certifications is essential to meet Walmart’s standards.

Leave a comment