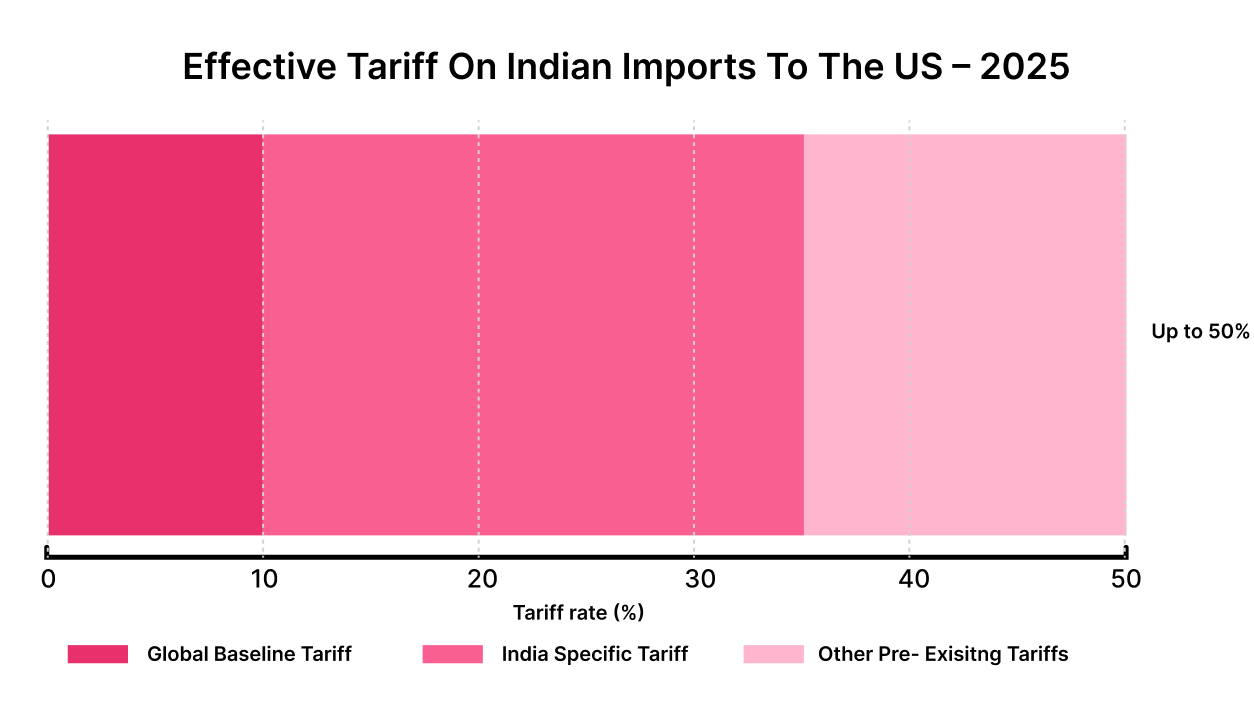

Your exports to the US just hit a critical fault line.Starting August 1, 2025, President Trump has imposed an additional 25% tariff on all Indian imports, marking one of the most aggressive trade measures targeting India to date. For many product categories, this pushes the total effective tariff to as high as 50%. This move puts Indian exports at risk, directly impacting thousands of businesses that rely on US demand.

The question many are now asking is: Why is Trump threatening India over tariffs? Officially, the reasons given are trade imbalances and protecting domestic jobs. However, India’s ongoing ties with Russia, particularly in energy and defense, have added tension. Behind the scenes, this tariff move reflects both geopolitical and economic factors, directly impacting Indian exporters.

The US remains India’s largest trading partner, with total goods and services trade reaching $212.3 billion in 2024. For exporters whose models are built around US market access, these tariffs threaten margins, operations, and long-term growth. But they also present an opportunity to rethink, realign, and strengthen global trade strategies.

This blog explores the tariff decision, India’s policy response, and what Indian exporters must do right now to stay competitive.

Key Takeaways

- The US has imposed an additional 25% tariff on Indian imports, impacting trade across key sectors.

- Pharma, textiles, and auto parts are most exposed, with smaller exporters facing the steepest cost pressure.

- You need to evaluate SKU-level risks, reduce US dependence, and tap into EU, GCC, and Southeast Asian markets.

- Domestic demand and targeted incentives can help offset short-term export losses.

- Long-term competitiveness depends on ESG compliance, supply chain agility, and early strategic shifts.

Overview of Trump’s Tariff Shift and What It Means for India

Trump’s 2025 tariff strategy revives the aggressive trade posture of his first term, but with a broader scope and sharper enforcement. This time, the tariffs apply globally, a flat 10% import duty now affects all countries exporting to the US, with higher rates for countries that run large trade surpluses with America.

The policy leans on the “reciprocal trade” idea. Trump argues that many countries, including allies, benefit from low US tariffs while maintaining high barriers of their own. By raising import duties across the board, he aims to pressure trading partners into reducing their own restrictions.

Unlike previous trade wars focused mainly on China, the 2025 policy expands the target list. India, Mexico, Vietnam, and the EU are all seeing increased scrutiny. India, in particular, faces a 25% tariff on select goods, citing its higher average tariff levels (12%) compared to the US (2.2%), as well as long-standing trade imbalances.

There’s also a geopolitical angle. Trump has linked tariff hikes to foreign policy choices, such as India’s defense and energy ties with Russia, signaling that trade penalties may extend beyond just economic concerns.

In short, Trump’s latest tariff plan is a multi-layered strategy that blends economics, diplomacy, and leverage. But, before reacting to the tariff shift, it’s important to understand what’s driving this sudden change, why India is in Trump’s crosshairs now, and what that means for your export game.

Why is Trump threatening India Over tariffs?

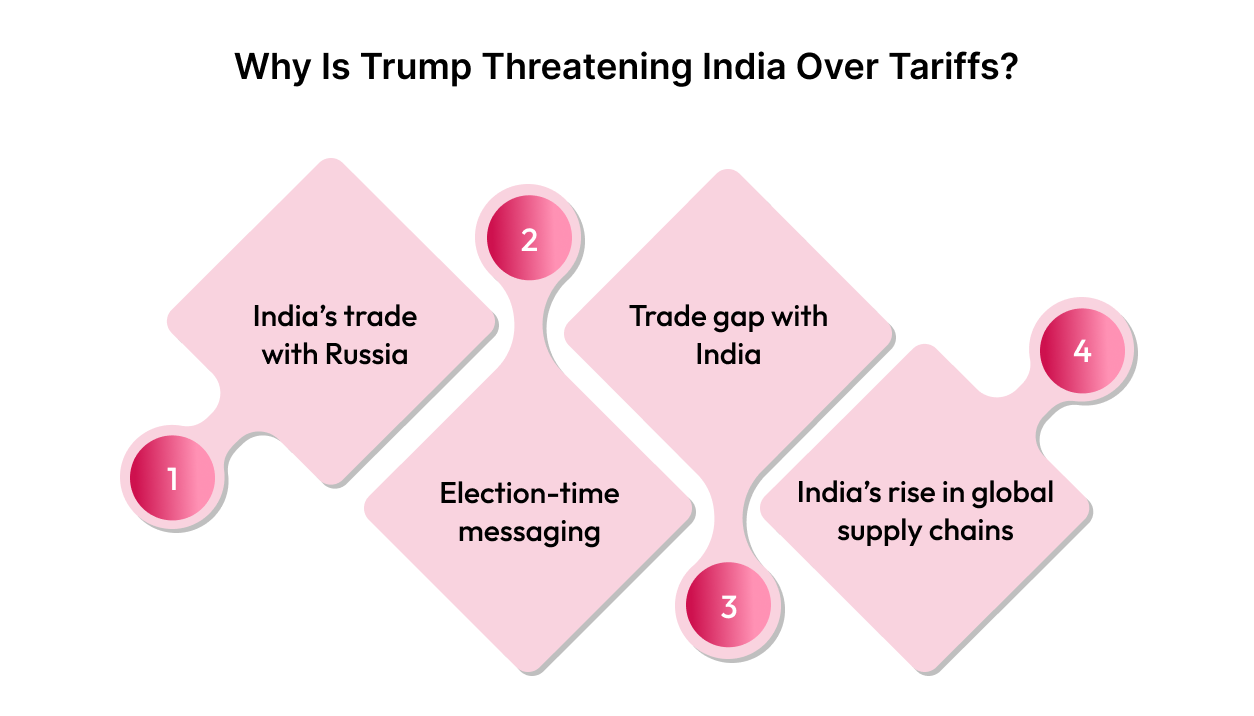

Trump’s tariff threats are closely tied to his “America First” agenda, where he pushes for more domestic manufacturing and fewer imports. If you’re exporting to the US, here’s what’s driving his focus on India:

- India’s trade with Russia: India has increased oil and defense imports from Russia, especially since the Ukraine war began. The US under Trump has taken a hard stance on Russia, and trade partnerships with it could bring extra attention.

- Election-time messaging: Trump’s campaign is again blaming imports for job losses in the US. While China remains his top target, he has also spoken out about India’s export growth in areas like pharma and auto parts.

- Trade gap with India: The US imported $41 billion more from India than it exported in 2025. Trump has criticized this gap in the past and even removed India from a trade benefits program during his earlier term.

- India’s rise in global supply chains: Many international firms are shifting production to India as they move away from China. Trump could view this as a new competitive threat, especially in electronics, textiles, and industrial goods.

Understanding the reasons behind Trump’s stance is only part of the picture. What matters now is how these tariff threats could shape real outcomes for Indian exporters and the broader economy.

How do US Tariffs Affect Indian Exporters and Economic Growth?

Trump’s comments on raising tariffs have brought renewed attention to India’s trade surplus with the US. While these statements may be politically charged, they highlight the real risks for Indian exporters in a climate of tariff uncertainty.

Tariffs affect how competitive Indian goods are in the US market, which in turn impacts jobs, revenue, and future investment.

- Sectors like pharma and textiles feel the pressure first: India’s pharma industry thrives on cost efficiency. Higher tariffs on generics make US buyers look elsewhere. Similarly, textile exports become less attractive when import costs rise, especially with countries like Vietnam offering better trade terms.

- Smaller exporters face the highest risk: Tariffs create uncertainty in pricing and volumes. For many small and mid-sized businesses, even a 10% increase in landed cost can mean losing key clients or shrinking profit margins.

- Shifts in supply chains take time: Large exporters may adapt over time by redirecting shipments or absorbing costs, but these shifts are slow. In the short term, any tariff hike can disrupt delivery schedules and hurt customer relationships.

- Overall export growth takes a hit: The US is India’s top export destination. Any tariff hike across categories adds friction to trade, slows down order volumes, and impacts the balance of payments. This can ripple into the broader economy through reduced output and employment.

While no immediate action has followed Trump’s remarks, the possibility of higher tariffs remains a concern for Indian exporters trying to maintain stable US demand.

Struggling with rising landed costs and unpredictable duty rates?

Contact Intoglo today!With higher tariffs looming and cost pressures mounting, you can’t afford to wait. If you are exporting to the US, these rising tariffs may already feel like a direct hit. Up next, you’ll see what steps you can take to stay competitive and reduce your risks.

Also Read: Who Pays Tariffs on US Imports? A Detailed Guide

What Strategic Options Can Indian Exporters Rely On?

With the US trade environment becoming increasingly uncertain, Indian exporters need to think beyond short-term gains. Here are four strategic routes to reduce dependency on the US market and build long-term resilience.

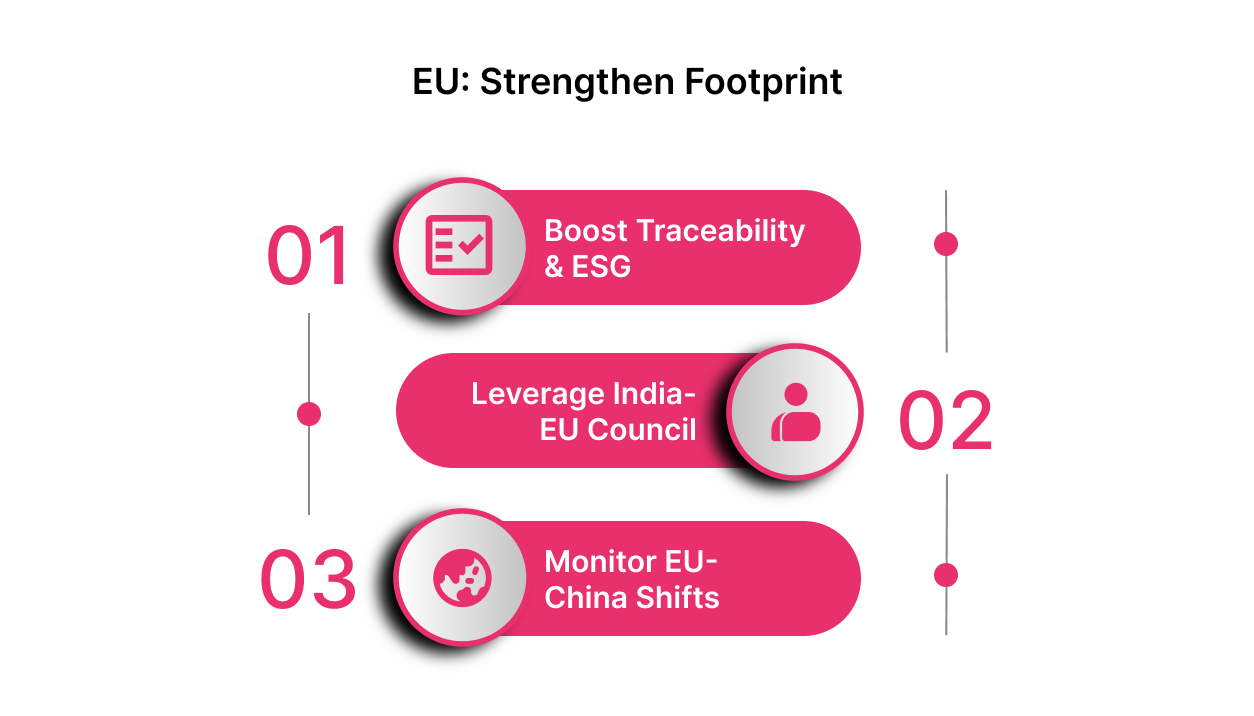

European Union: Strengthen your footprint in a value-driven, stable trade zone

The EU is India’s second-largest trade partner, with bilateral merchandise trade reaching around $136–$137 billion in 2024–25. It now accounts for 11.5% of India’s total goods trade, making it a key market for Indian exporters. For Indian exporters, this opens clear advantages:

- Double down on traceability and ESG compliance: The EU rewards suppliers who can prove ethical sourcing, carbon reduction, and transparency. Stand out by aligning with their Green Deal standards early.

- Utilize the India-EU Trade and Technology Council: Target co-development in pharma, clean energy, and digital tech through joint R&D, pilot programs, or market entry support.

- Track shifts in EU-China sourcing: Identify sectors where the EU is actively reducing China exposure (e.g., chemicals, electronics) and position India as a ready alternative.

Southeast Asia: Expand into growing consumer markets with strong bilateral ties

ASEAN nations offer favorable trade terms, rising demand, and shorter supply chains. They’re also accelerating economic integration with India.

- Use India’s FTAs with ASEAN countries: Check the tariff benefits available under current agreements and adjust your SKUs or logistics to make the most of them.

- Localize faster with flexible fulfillment models: Offer faster delivery and better service levels by partnering with in-country warehousing or last-mile networks.

- Follow Chinese capital outflows: As Chinese companies exit or reduce their presence in ASEAN, Indian exporters can offer replacements in sectors like auto parts, electronics, and textiles.

GCC Region: Build on high trust and logistics advantages

The Gulf region offers low entry barriers, cultural alignment, and strong demand for Indian goods across FMCG, agriculture, and industrial inputs.

- Target Dubai and Saudi Arabia for re-exports: Set up regional hubs that serve both local markets and onward shipments to Africa, Europe, and the US.

- Use CEPA with UAE for preferential access: Identify SKUs that benefit from duty elimination or reduced logistics costs and push them through UAE-based partners.

- Promote ‘India-made’ as premium and reliable: The Indian diaspora drives strong brand affinity, use that to position your products as trusted, high-quality alternatives to Chinese or Western brands.

Domestic Market: Hedge global risk through demand at home

India’s consumption base is growing rapidly. A strong domestic business can help stabilize cash flows when export markets tighten.

- Diversify product lines for Indian buyers: Adapt SKUs, pricing, or packaging to fit Indian retail buyers, or tap into new revenue through D2C platforms like Amazon. With Intoglo’s FBA-ready shipping, direct carrier partnerships, and zero-agent delays, you can make this shift faster and more profitably.

- Use spare capacity to maintain margins: If export orders slow, channel production toward government contracts, institutional buyers, or platforms like ONDC.

- Monitor export-linked government incentives: Schemes like RoDTEP or PLI can buffer cost pressures, keep compliance ready even for domestic sales if incentives are tied to export performance.

Many exporters are also switching to digital freight partners like Intoglo that offer direct access to shipping lines, eliminating delays and cost escalations caused by third-party agents.

Expanding beyond the US? Get end-to-end FCL shipping across new trade lanes.

Get instant quotes!Identifying strategic options is only one side of the equation. To support these moves at scale, Indian exporters also need an ecosystem that backs them with the right policies, infrastructure, and market access. That’s where the government’s role becomes critical.

Also Read: Get Instant FCL Shipping Quotes From India to USA

What India Is Doing to Protect Its Export Competitiveness?

India’s response combines immediate risk mitigation with long-term trade resilience. The strategy aims to limit short-term disruption while creating more durable export opportunities across global markets.

Diplomatic Efforts to Ease Tariff Pressure

Indian trade officials are engaging in behind-the-scenes negotiations, even as public tensions remain. The focus is shifting from large-scale trade deals to targeted, sector-specific discussions. Industries with deep integration into US supply chains, like pharmaceuticals and IT services, may secure exemptions from broader tariff hikes.

India is also working through multilateral platforms such as the G20, Quad, and others to build coordinated pressure. Aligning with other impacted economies increases leverage while preserving strategic ties with the US.

Building Alternative Corridors and Trade Agreements

The India-Middle East-Europe Economic Corridor (IMEC) has gained momentum as a way to reduce reliance on the US market. This infrastructure-led trade route could diversify export destinations and logistics dependencies.

India is also expediting free trade agreement (FTA) talks with the UK, EU, and EFTA to secure preferential access to developed markets. Meanwhile, deeper integration with ASEAN and Indo-Pacific blocs strengthens India’s foothold in regional trade, reducing exposure to any single partner.

Targeted Support for Exposed Sectors

Sectors facing high US tariff risk, such as electronics, pharmaceuticals, and textiles, are seeing expanded Production Linked Incentive (PLI) support. These measures focus on boosting productivity and value addition rather than offering direct subsidies.

Government incentives are also backing R&D-led innovation to help exporters move beyond cost-based competition. Higher-value products tend to be less vulnerable to pricing pressures created by tariffs.

To offset liquidity challenges, public financing schemes are being ramped up. Exporters dealing with lower margins and longer payment cycles now have better access to working capital support.

Stay ahead of shifting trade rules and port costs with timely alerts.

Contact Intoglo for shipping intelligence!While India is actively working on multiple fronts to safeguard its export strength, policy support alone would not guarantee success. Exporters need to respond just as strategically. Staying aligned with the government’s efforts is important, but avoiding critical missteps is equally essential if you want to stay competitive in the long run.

Key Mistakes to Avoid During Tariff Shifts

It’s tempting to treat these tariff threats as one-off shocks. But they’re part of a much bigger shift in how global trade works. If you make the wrong moves now, chasing short-term gains and locking into bad markets, you could face much steeper losses down the line.

Let us have a look at what Indian exporters should avoid in this new environment:

1. Betting too heavily on protectionist markets

The US is not the only one turning inward. The EU is also pushing “Buy European” rules and homegrown supply chains. If you’re overexposed to any one of these markets, especially without strong local partnerships or compliance support, your risk goes up. Spread your bets.

2. Overestimating what trade blocs can deliver

Being part of Quad, IPEF, or BRICS+ doesn’t automatically mean more orders or smoother logistics. These platforms shape trade policy, but you still need to align with what importers want: faster delivery, lower landed costs, ESG compliance, and digital paperwork. Don’t assume bloc membership does the work for you.

3. Ignoring the rise of green trade barriers

Carbon taxes, sustainability audits, and environmental scorecards are becoming entry barriers. If you treat ESG as a box to tick instead of a long-term shift, you’ll keep running into last-minute compliance issues at customs. Use tools like a carbon emission calculator to measure and manage your shipment footprint before it becomes a compliance problem.

4. Taking sides too early

India’s edge lies in staying flexible. Leaning too far into any one bloc, whether Western or non-Western, can close doors elsewhere. The smarter play is to remain neutral, build relationships across multiple regions, and keep switching costs low.

Conclusion

US tariff pressure will continue to test Indian exporters, especially those targeting the American market. But the real risk lies in delay, missing the chance to reassess cost structures, shift routes, or hedge against future disruptions.

That’s where Intoglo steps in. Built specifically for India-to-US trade, Intoglo helps exporters respond faster, manage costs more precisely, and stay compliant, even as policies change.

Here’s what Intoglo offers:

- Door-to-door FCL shipping from your Indian warehouse to over 41,000 zip codes across the United States.

- Instant rate quotes directly from shipping lines with full cost visibility upfront.

- End-to-end shipment tracking via the Glotrack platform, including real-time updates and document management.

- AI-powered HS Code scanner to classify goods accurately and estimate import duties.

- Amazon FBA-ready logistics with palletization, container stuffing, and last-mile delivery to Amazon warehouses.

- US-based warehousing through a 50+ facility network, offering transloading, order sorting, and tailored fulfillment.

With tariffs in flux, exporters need more than visibility; they need execution partners who reduce complexity and plug cost leaks. Intoglo achieves this through direct carrier access, eliminating intermediaries, and ensuring full-price transparency, which helps Indian exporters stay sharp and competitive in the US market.

Contact Intoglo’s expert team today to secure smarter routes and cost-effective shipping from India to the US.

FAQ’s

1. Does Trump have the authority to impose tariffs?

Yes. Under US trade laws, the President can impose tariffs citing national security, economic threats, or unfair trade practices, often bypassing Congress through provisions like Section 232 or 301 of the Trade Act.

2. Why did Trump start the trade war?

Trump launched the trade war to counter trade imbalances and push countries, especially China, to change practices like IP theft, forced tech transfers, and subsidies that he viewed as harmful to US industries.

3. What are the negative effects of tariffs?

Tariffs raise import costs, disrupt supply chains, trigger retaliation, and reduce export competitiveness. Businesses often face lower margins, while consumers deal with higher prices and limited product choices in the long run.

4. What is a tariff in simple terms?

A tariff is a government-imposed tax on imported goods. It makes foreign products more expensive, often to protect domestic industries or to pressure trade partners into changing economic policies.

5. Did tariffs cause the Great Depression?

Tariffs like the Smoot-Hawley Act worsened the Great Depression. They triggered retaliatory measures, collapsed global trade, and deepened economic hardship, especially for countries heavily reliant on exports.

Leave a comment